FKLI: Pullback To Test Immediate Support

rhboskres

Publish date: Fri, 22 Oct 2021, 05:36 PM

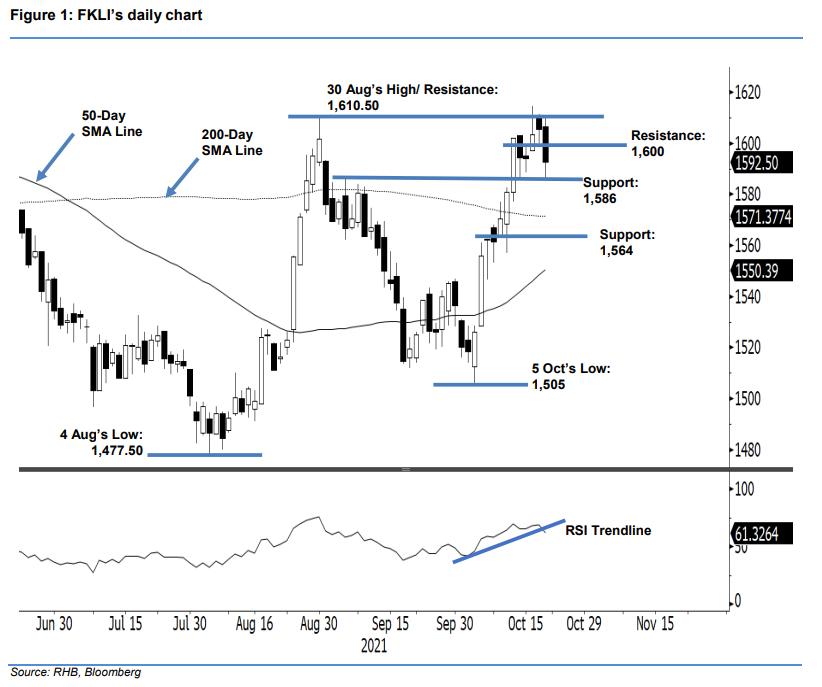

Maintain long positions. The FKLI failed to extend the bullish momentum yesterday, and pulled back by 13 pts to close at 1,592.50 pts, thereby falling below the 1,600-pt mark. Yesterday, the index initially opened higher at 1,606.50 pts. After touching the day’s high of 1,610 pts, it dropped to the day’s low of 1,586 pts before closing. The latest session showed that selling pressure is persisting above the 1,600-pt level. The RSI is rounding down and has dipped below the trendline – indicating that in the immediate session, the upward movement is taking a pause. The index may move sideways for a consolidation before a fresh attempt to test the immediate resistance is made again. In the event, the index breaches the 1,586-pt level or the immediate support, expect a deeper correction towards the 200-day SMA line. As long as the index stays above the immediate support, we are maintaining a positive trading bias.

Traders should remain in long positions, initiated at 1,556 pts or the closing level of 6 Oct. To manage the trading risks, the trailing-stop is at 1,586 pts.

The immediate support has been revised to 1,586 pts (14 Oct’s low) followed by 1,564 pts (11 Oct’s low). Towards the upside, the nearest resistance is pegged at 1,600 pts, followed by 1,610.50 pts or the high of 30 Aug.

Source: RHB Securities Research - 22 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024