FKLI - Struggling To Bounce Up Further

rhboskres

Publish date: Thu, 28 Oct 2021, 05:13 PM

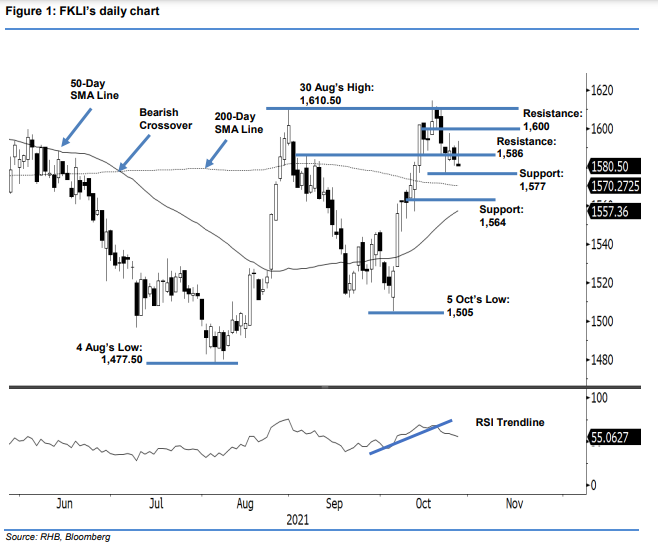

Maintain short positions. The FKLI failed in its attempt to move higher yesterday, as strong intraday profit-taking pulled the reading down by 3.5 pts at the close, at 1,580.5 pts. It opened at 1,581.5 pts, then printed the day’s low of 1,580.5 pts before rebounding strongly towards the intraday high of 1,593.5 pts in the early session. Then, selling pressure emerged to shift the direction southwards until the close, which was also the intra-day low. The black body candlestick with long upper shadow, which closed below the 1,586-pt resistance, indicates that the bearish momentum should continue towards the next support level of 1,577 pts in the coming sessions – in line with the weakening RSI. As such, we stick to a negative trading bias.

Traders should remain in short positions, initiated at the closing level of 26 Oct, ie 1,584 pts. To manage trading risks, the initial stop-loss threshold is at the 1,610-pt level.

The immediate support is set at 1,577 pts (22 Oct’s low), followed by the lower support of 1,564 pts (11 Oct’s low). Conversely, the nearest resistance is fixed at 1,586 pts, followed by 1,600 pts.

Source: RHB Securities Research - 28 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024