FCPO - Falling Beneath The MYR5,000 Mark

rhboskres

Publish date: Thu, 28 Oct 2021, 05:14 PM

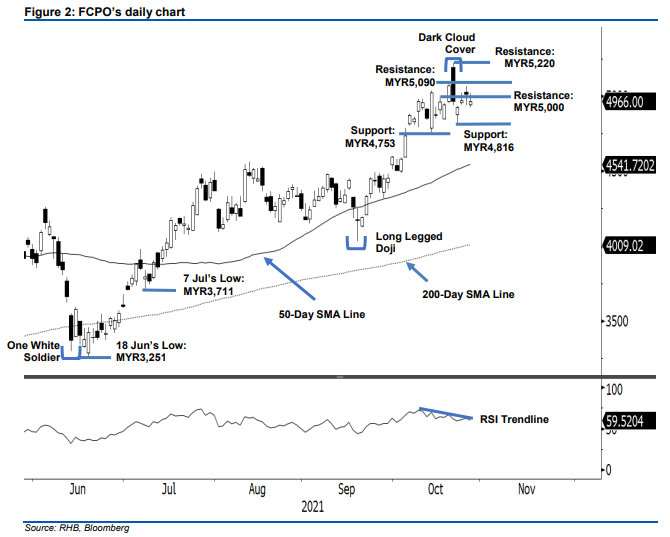

Keep short positions. The FCPO underwent a pullback yesterday, as it fell by MYR46.00 to close at MYR4,966 – breaching below the MYR5,000 support. The commodity opened lower at MYR4,942 to hit the intraday low of MYR4,923 before buying pressure kicked in. It then bounced off to touch the intra-day high of MYR5,019 before retracing strongly towards the end of the session, which was a tad above the opening level. The latest session – which started lower, beneath the MYR5,000 immediate support – formed a white body candlestick with long upper shadow. This indicates strong selling pressure is imminent, as the commodity printed a “lower high” bearish formation. This is also in tandem with the weakening RSI, which as been pointing downwards recently. Hence, expect the bears to drag the commodity lower towards the immediate support of MYR4,816 – due to this, we also maintain a bearish trading bias.

Traders should remain in short positions, which were initiated at MYR4,924, or the closing level of 22 Oct. To manage the trading risks, the initial stop-loss is pegged at MYR5,090.

The immediate support is pegged at MYR4,816 – 22 Oct’s low, followed by MYR4,753, or the low of 13 Oct. Towards the upside, the immediate resistance is at MYR5,000, then at MYR5,090 – or the high of 20 Oct

Source: RHB Securities Research - 28 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024