Hang Seng Index Futures - Consolidating Sideways

rhboskres

Publish date: Fri, 29 Oct 2021, 04:40 PM

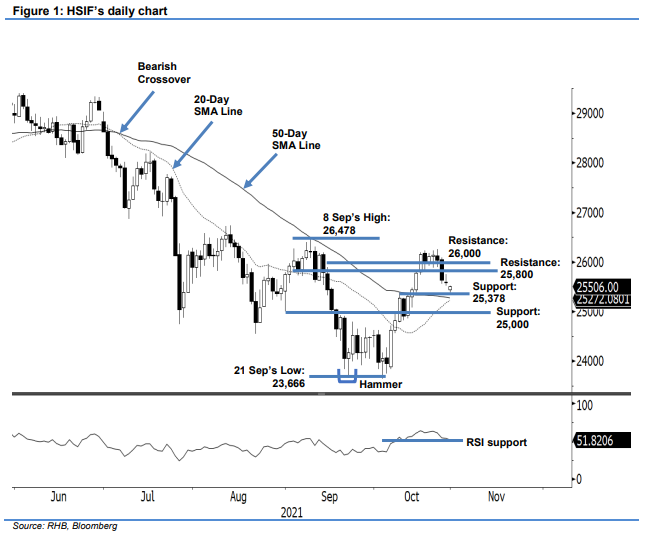

Maintain long positions. The HSIF moved sideways on Thursday, as the October futures contract fell 47 pts to settle at 25,593 pts. It opened at 25,600 pts and staged a brief rebound to test the 25,757-pt day high. Momentum waned after touching the intraday high, and profit-taking dragged it to the 25,554-pt day low before closing weaker at 25,593 pts. In the evening session, the November futures contract saw neutral price action, and last traded at 25,506 pts. The index has seen correction for three consecutive sessions, and has yet to establish its interim base. If the 20- day SMA line crosses above the 50-day SMA line, we expect the index to react positively, and bounce off the moving average line to resume its upward movement. On the other hand, a breach of the moving average line will indicate that the recent rally – which started in October – is coming to an end. At this stage, we keep our positive trading bias until the trailing-stop is triggered.

We recommend traders stay with the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage downside risks, the trailing-stop is placed at 25,250 pts, a level near the 50-day SMA line.

The nearest support is revised to 25,378 pts –19 Oct’s low – followed by the 25,000-pt round number. On the upside, the immediate resistance is pegged at 25,800 pts, followed by the 26,000-pt round figure.

Source: RHB Securities Research - 29 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024