WTI Crude - Struggling to Bounce Higher

rhboskres

Publish date: Fri, 29 Oct 2021, 04:41 PM

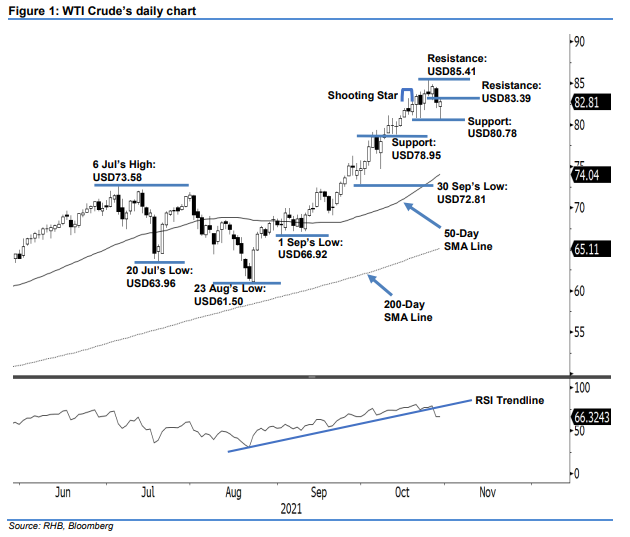

Stay in short positions. The WTI Crude recouped all its intraday losses yesterday, rebounding from the immediate support to close USD0.15 higher at USD82.81. It began lower at USD82.25 and dipped to the day’s low of USD80.58 during the early part of the Asian trading session. It then rebounded gradually for the rest of the session, touching the day’s high of USD83.21 before retracing mildly to close. The white body candlestick with long lower shadow showed that strong buying pressure has emerged above the immediate support level of USD80.78. However, strong selling interest is also seen at the USD83.39 immediate resistance. This, coupled with the RSI, which has been showing weak momentum lately, leads us to believe that positive momentum will be short lived. We expect selling pressure to resume in the coming sessions. Unless the stop-loss is breached, we will stick to our negative trading bias.

We suggest traders maintain the short positions initiated at USD82.66, or the closing level of 27 Oct. To manage trading risks, the initial stop-loss threshold is fixed at USD85.41.

The support levels are set at USD80.78 – 20 Oct’s low – and USD78.95, which was 11 Oct’s low. The resistance levels are at USD83.39, or 25 Oct’s low, followed by USD85.41, which was 26 Oct’s high.

Source: RHB Securities Research - 29 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024