COMEX Gold - Positive Momentum Gains Traction

rhboskres

Publish date: Fri, 29 Oct 2021, 04:43 PM

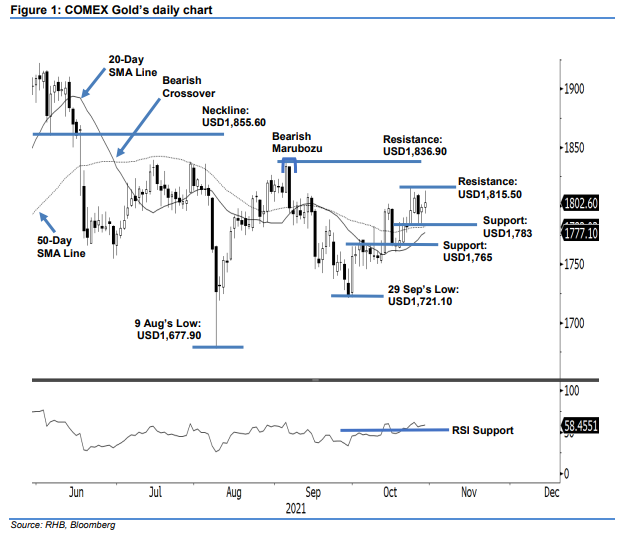

Maintain long positions. The COMEX Gold saw bullish momentum pick up again yesterday, rising USD3.80 to settle at USD1,802.60. It started Thursday’s session at USD1,798.70 and moved sideways for most of the session. Volatility picked up during the US trading session, with the commodity swinging up to test the day’s high of USD1,812.70. It then dived rapidly to the day’s low of USD1,793.10. It rebounded later in the session to close in positive territory. The latest session’s low is higher than the previous session’s low, indicating that the bulls remain in control, and have technical advantage. We observe that the 20-day SMA line is trending higher, and about to cross above the 50-day SMA line. In the event that a bullish crossover happens, this will strengthen the technical setup and provide strong downside support. As the COMEX Gold’s upward movement remains on track, printing a “higher low” bullish pattern, we stick to our positive trading bias.

Traders should retain the long positions initiated at USD1,784.90, or the closing level of 20 Oct. To manage downside risks, the stop-loss threshold is placed at USD1,760.

The immediate support is adjusted to USD1,783 – 26 Oct’s low – followed by the USD1,765 whole number. The nearest resistance is eyed at USD1,815.50, or 22 Oct’s high, and the subsequent resistance is at USD1,836.90, which was the high of 3 Sep.

Source: RHB Securities Research - 29 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024