Hang Seng Index Futures: Selling Pressure Persists

rhboskres

Publish date: Mon, 01 Nov 2021, 08:43 AM

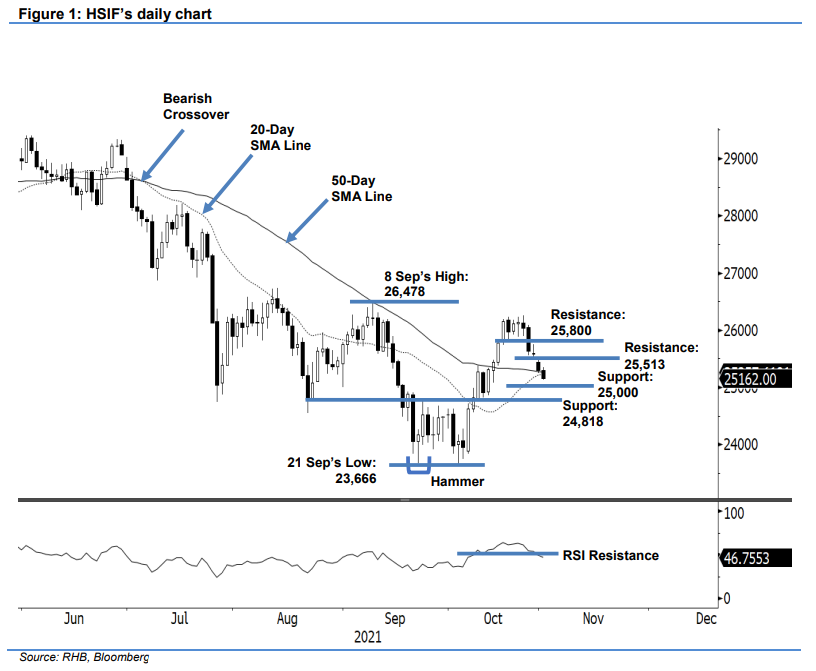

Trailing-stop mark triggered; initiate short positions. The HSIF’s November futures contracts continued to experience selling pressure, falling 110 pts and settling Friday’s day session at 25,304 pts. It initially opened weaker at 25,487 pts and moved sideways for most of the session. During the intraday period, it reached the 25,249-pt day low and closed weaker at 25,304 pts. Despite US peers moving higher during the evening session, the HSIF bucked the trend, drifting 142 pts lower and closing at 25,162 pts. The latest evening session also saw the index close below the 20-day SMA line. The price action weakness showed the bears were in control. The RSI dropped below the 50% threshold, echoing the view that negative price actions may follow through in upcoming sessions. The HSIF has now breached below the trailing stop and we expect the downside risk to persist in the near future amid weak momentum. As such, we shift over to a negative trading bias.

We closed out the long positions initiated at 24,809 pts – 7 Oct’s evening session’s close – after the 25,250-pt trailing stop was triggered. We initiate short positions at 29 Oct’s evening session’s close, ie 25162 pts. To manage the trading risks, the initial stop-loss threshold is set at 25,800 pts.

The nearest supports: The 25,000-pt round figure and 12 Oct’s low, ie 24,818 pts. On the upside, the immediate resistance is revised to 29 Oct’s high, 25,513 pts, with subsequent resistance at the 25,800-pt whole number.

Source: RHB Securities Research - 1 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024