E-Mini Dow: Eyeing to Breach the Immediate Resistance

rhboskres

Publish date: Mon, 01 Nov 2021, 08:44 AM

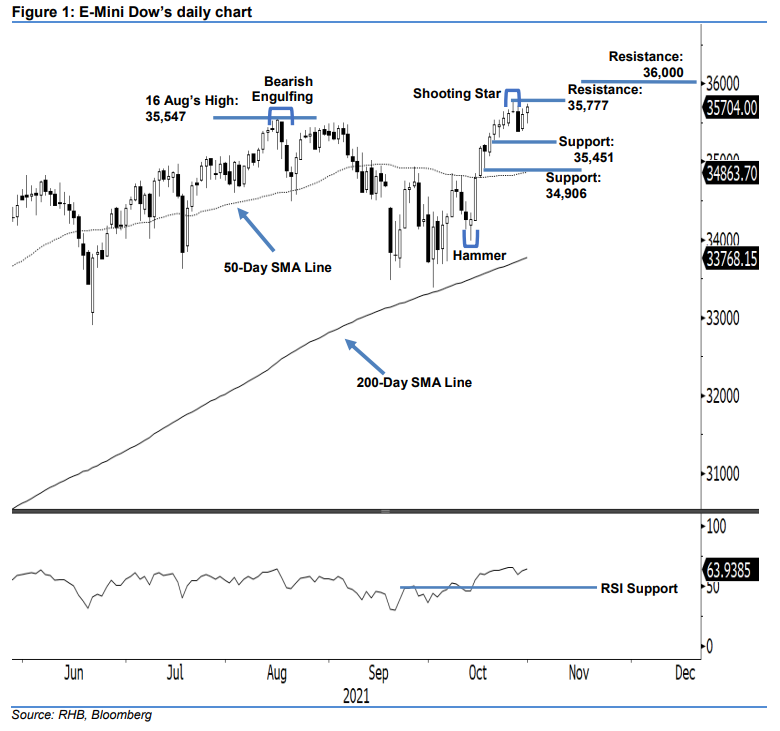

Maintain short positions. The E-Mini Dow continued its recent rebound last Friday, rising 91 pts to close at 35,704 pts – slightly below the immediate resistance of 35,777 pts. It opened on a positive note at 35,636 pts but gradually moved lower during the Asian trading session, which saw the index touching the day’s low of 35,486 pts. It then rebounded higher following the US trading session to hit the day’s peak of 35,746 pts before closing. The white candlestick with a long lower shadow formed last Friday signals buying interest that emerged on Thursday had followed through on Friday. However, it failed to breach the immediate resistance – also its stop-loss level – and has yet to form a “higher high” bullish pattern. As the RSI strength is pointing higher, we believe buying interest is picking up and there is a higher probability to breach the resistance level, with a “higher high” bullish formation. Since the stop-loss level has not been triggered, we keep to our negative trading bias.

Traders are advised to stick to short positions initiated at the closing level of 27 Oct, or 35,389 pts. To manage trading risks, the stop-loss threshold is fixed at 35,777 pts.

The immediate support is located at 35,451 pts, or 25 Oct’s low, followed by 34,906 pts, or 18 Oct’s low. On the upside, the immediate resistance is set at 35,777 pts, before possibly reaching the 36,000-pt level.

Source: RHB Securities Research - 1 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024