WTI Crude: Inching Higher

rhboskres

Publish date: Mon, 01 Nov 2021, 08:44 AM

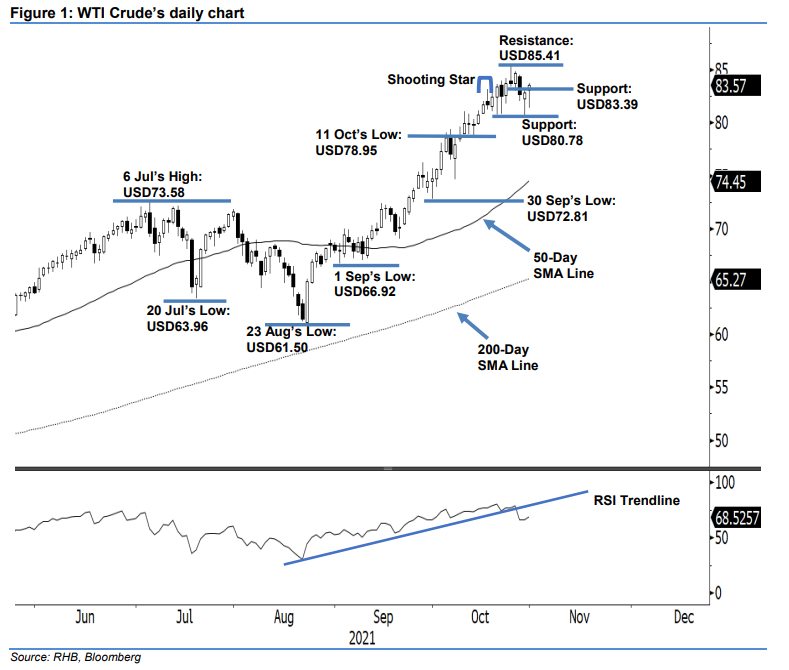

Stay in short positions. The WTI Crude recouped all its intraday losses last Friday to close on positive momentum by inching USD0.76 higher to USD83.57. It began slightly higher at USD83.09 then moved sideways before dipping to the day’s low of USD81.41 during the beginning of the US trading session. It then rebounded strongly, touching the day’s high of USD83.74 prior to closing. The white body candlestick with a long lower shadow that formed for two consecutive sessions indicates that the strong buying momentum is building up and eyeing to bounce above the recent high of USD85.41. However, the RSI strength is still below the positive trendline, which signals a short-lived positive momentum. Coupled with a “lower high” pattern, we expect selling pressure to resume in the coming sessions. Unless the stop-loss is triggered, we keep to our negative trading bias.

We suggest traders stick to short positions initiated at USD82.66, or the closing level of 27 Oct. To manage trading risks, the initial stop-loss threshold is pegged at USD85.41.

The support levels are revised to USD83.39 – 25 Oct’s low – and USD80.78, which was 20 Oct’s low. The resistance levels are at USD85.41, or 26 Oct’s high, followed by USD90.00.

Source: RHB Securities Research - 1 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024