FKLI: Testing The 50-Day SMA Line Support

rhboskres

Publish date: Mon, 01 Nov 2021, 08:48 AM

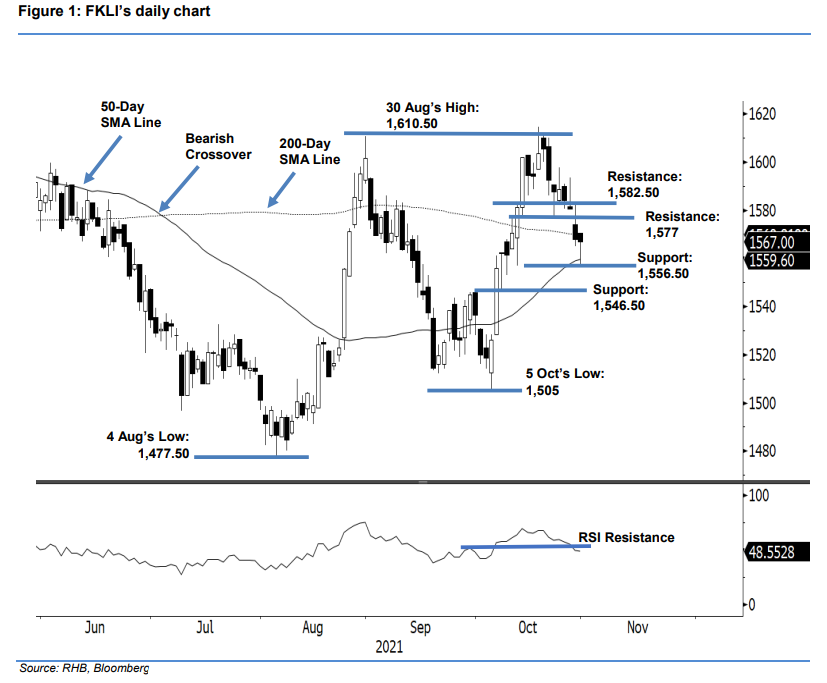

Maintain short positions. On the last trading session of October, the FKLI continued to see selling pressure, retreating 1 pt to settle at 1,567 pts. Last Friday, the benchmark index opened near the 200-day SMA line at 1,570.50 pts. After the opening, selling pressure dragged it down to test the 50-day SMA line at 1,556.50 pts. Bargain-hunting emerged near the 50-day SMA line, lifting the index higher during the afternoon to its close. The latest session indicated that strong support formed near the 50-day SMA line. If the FKLI stays above the 50-day SMA line, it may climb higher above the 200-day SMA line, and cross the immediate resistance of 1,577 pts. On the other hand, if selling pressure accelerates, the index may drop below the 50-day SMA line and drift lower. At this stage, the index is still moving lower amid a “lower highs and lower lows” bearish pattern – so we maintain a negative trading bias.

We advise traders to stick to short positions, initiated at the closing level of 26 Oct, ie 1,584 pts. To mitigate the trading risks, the stop-loss is now at 1,583 pts.

The immediate support has been revised to 1,556.50 pts (29 Oct’s low), followed by 1,546.50 pts (7 Oct’s low). The nearest resistance is pegged at 1,577 pts or the high of 11 Oct, then 1,582.50 pts or the high of 28 Oct.

Source: RHB Securities Research - 1 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024