FCPO: Climbing Back Above The MYR5,000 Mark

rhboskres

Publish date: Mon, 01 Nov 2021, 08:54 AM

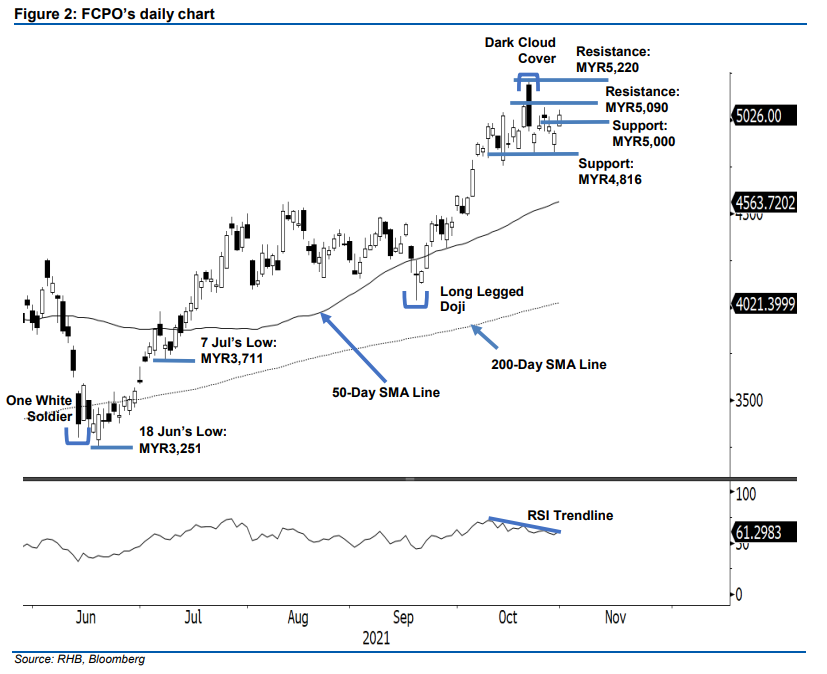

Maintain short positions. The FCPO extended its technical rebound on last Friday, climbing MYR97.00 to settle at MYR5,026. Initially, the commodity gapped up and opened stronger at MYR4,969. Amid positive sentiment, the commodity formed its intraday low at MYR4,964, then progressed higher to test the intraday high of MYR5,054 before closing. The latest session reaffirmed strong support has formed at the MYR4,816 level. For the immediate session, selling pressure may emerge near the immediate resistance of MYR5,090. Crossing this threshold may see commodity attract follow-through buying interest – which should try to negate the bearish candlestick Dark Cloud Cover, and test the record high of MYR5,220. On the other hand, if the bullish momentum falters, the commodity may revert to a correction, falling below the MYR5,000 psychological level. At this stage, we still maintain a bearish trading bias until the stop-loss has been breached.

Traders should keep short positions, which were initiated at MYR4,924 or the closing level of 22 Oct. To manage trading risks, the initial stop-loss is fixed at MYR5,090.

The nearest support is now set at MYR5,000, followed by MYR4,816 or the low of 22 Oct. Towards the upside, the immediate resistance is at MYR5,090 – 20 Oct’s high, then the all-time high of MYR5,220.

Source: RHB Securities Research - 1 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024