WTI Crude: Intraday Profit-Taking Amid Bullish Momentum

rhboskres

Publish date: Tue, 02 Nov 2021, 08:38 AM

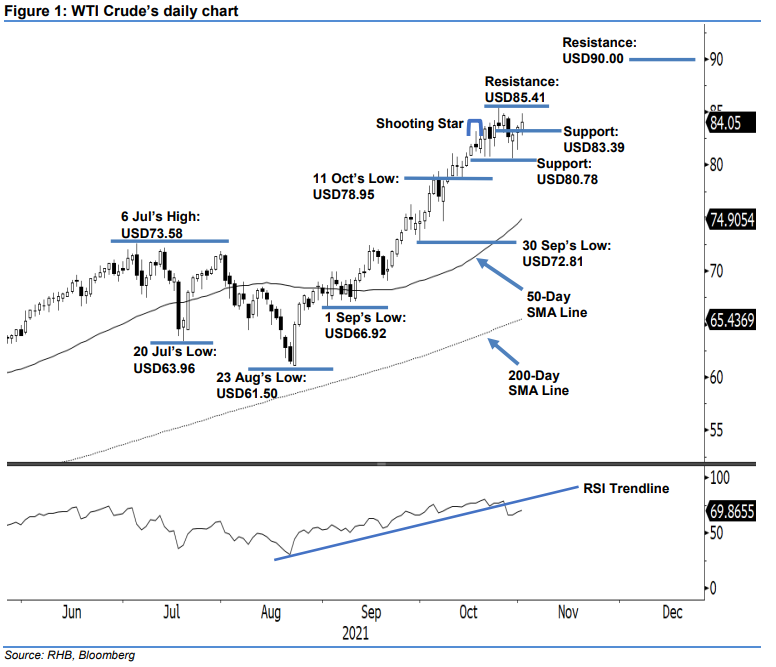

Maintain short positions. The WTI Crude continued its positive momentum yesterday after managing to close USD0.48 higher at USD84.05 – with moderate intraday profit-taking from the day’s peak. It started mildly lower at USD83.36 to hit the day’s low at USD82.74 before oscillating in a sideways direction during the Asian trading session. Following the European trading session, the buying interest emerged to propel the commodity towards the intraday high at USD84.88 before retracing moderately at its close. Yesterday’s white body candlestick with long upper shadow indicates that strong buying momentum has followed through, but strong selling pressure then emerged from the day’s peak. Conversely, the RSI strength has yet to mark above the positive trendline, which may signal a short-lived positive momentum in the immediate sessions. Hence, we expect selling pressure to re-emerge in the coming sessions. Unless the stop-loss mark is triggered, we stay with our negative trading bias.

We suggest traders keep to short positions initiated at USD82.66 or the closing level of 27 Oct. To manage trading risks, the initial stop-loss threshold is located at USD85.41.

The support levels are fixed at USD83.39 – 25 Oct’s low – and USD80.78, which was 20 Oct’s low. The resistance levels remain at USD85.41 – 26 Oct’s high – and followed by USD90.00.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024