COMEX Gold: Consolidating Sideways

rhboskres

Publish date: Tue, 02 Nov 2021, 08:41 AM

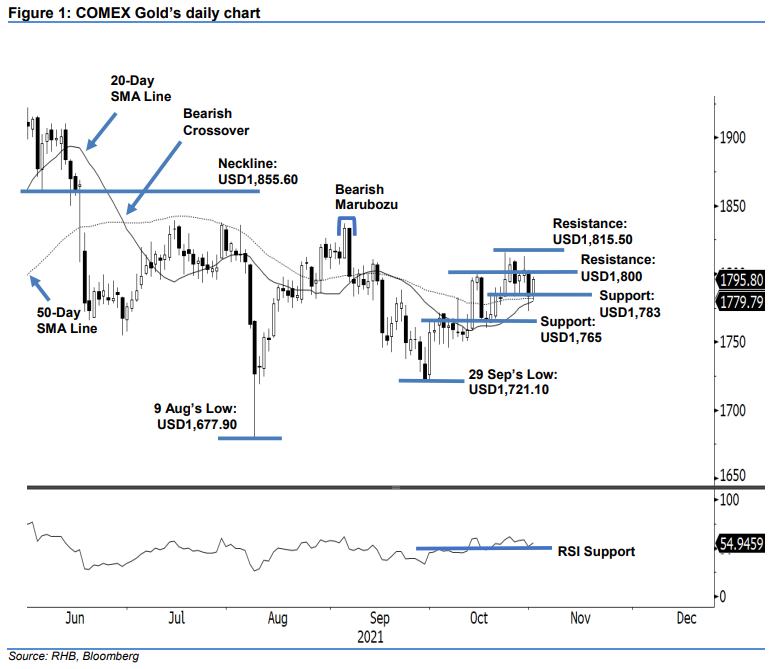

Maintain long positions. The COMEX Gold bounced off the 50-day SMA line yesterday, rising USD11.90 to settle at USD1,795.80. The commodity initially started off at USD1,785.30. After setting its foothold at the USD1,780.20 mark, it rose higher amid positive buying interest, touching the USD1,797.50 day high before closing at USD1,795.80. The latest session affirmed that the 50-day SMA line is acting as strong downside support. The yellow metal may continue consolidating along the moving average line before staging a fresh attempt to retest the USD1,800 psychological level. We have observed that the 20-day SMA line is about to cross above the 50-day one – if this bullish crossover happens, the momentum may lead the COMEX Gold’s prices to move higher. As of now, we continue to hold on to our positive trading bias.

Traders are recommended to retain the long positions initiated at USD1,784.90, ie the closing level of 20 Oct. To control the trading risks, the stop-loss threshold is set at USD1,765.

The immediate support is marked at USD1,783 – 26 Oct’s low – and followed by the USD1,765 whole number. The first resistance is pegged at the USD1,800 round figure, followed by the higher hurdle of USD1,815.50 or 22 Oct’s high.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024