E-mini Dow: Breaching Above the Immediate Resistance

rhboskres

Publish date: Tue, 02 Nov 2021, 08:42 AM

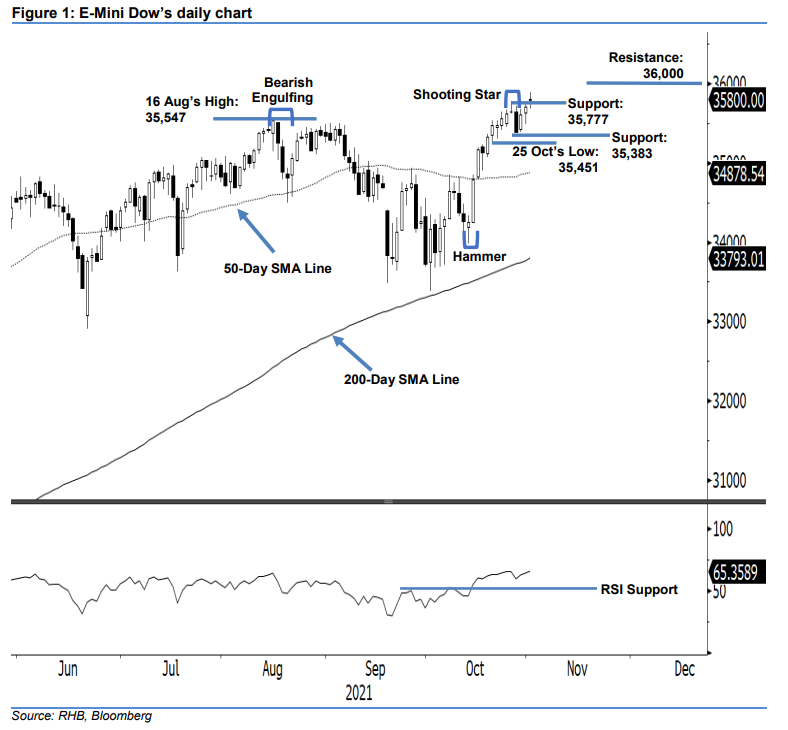

Stop-loss mark triggered; initiate long positions. The E-Mini Dow resumed its recent rebound by reprinting the new high level yesterday, climbing 96 pts to settle at 35,800 pts – moving past the 35,777-pt immediate resistance. It started on a higher note at 35,796 pts before whipsawing throught the session – touching the intraday high and low at 35,891 pts and 35,683 pts. The index bounced off strongly from bottom towards the close at 35,800 – merely 4 pts above the opening. The doji neutral candlestick with upper and lower shadows above the immediate resistance level suggests that, despite strong buying interest emerging, the continuation of the bullish momentum in the immediate sessions is expected to be muted – with a higher probability for mild profit-taking. Nevertheless, the medium-term direction has shifted northwards, since it has formed a “higher high” bullish pattern that is supported by the RSI strength pointing higher. As the stop-loss level is triggered, we shift to a positive trading bias.

We closed out our short positions initiated at 35,389 pts – 27 Oct’s closing level – after the stop-loss mark at 35,777 pts was triggered. Conversely, we initiate long positions at the closing level of 1 Nov, ie 35,800 pts. To manage trading risks, the initial stop-loss threshold is placed at 35,383 pts.

The immediate support is located at 35,777 pts, followed by 35,383 pts – 27 Oct’s low. On the upside, the immediate resistance is set at 36,000 pts before possibly reaching the 36,500-pt level.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024