FCPO: Selling Pressure Increases Near MYR5,000 Threshold

rhboskres

Publish date: Tue, 02 Nov 2021, 08:47 AM

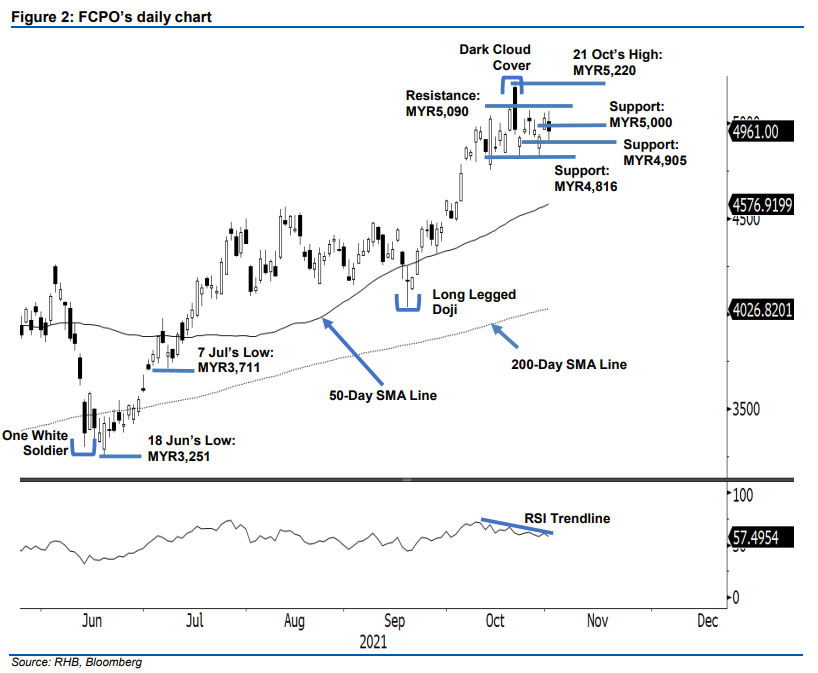

Maintain short positions. The FCPO saw profit-taking activities emerging near the MYR5,000 level, and shed MYR65.00 to close at MYR4,961 yesterday. Initially, it opened at MYR5,010 and rose to test the session’s high of MYR5,063. After it reached the intraday high, sentiment turned cautious in the afternoon. The commodity gapped down and hit the session’s low of MYR4,905 before rebounding higher to its close. The latest price action shows that selling pressure is still in effect above the MYR5,000 mark. If the bullish momentum ramps up in the sessions ahead and breaches the psychological level again, this may result in the commodity moving upwards. Meanwhile, with the RSI rounding down, the FCPO is likely to undergo a southward correction in the immediate session. For now, we maintain a bearish trading bias until the upside stop-loss has been triggered.

Traders should maintain short positions, which were initiated at MYR4,924 or the closing level of 22 Oct. To mitigate trading risks, the stop-loss has been revised to MYR5,030.

The nearest support is now at MYR4,905 or the low of 1 Nov, followed by MYR4,816 ie the low of 22 Oct. Towards the upside, the immediate resistance is pegged at MYR5,000, then MYR5,090 or the high of 20 Oct.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024