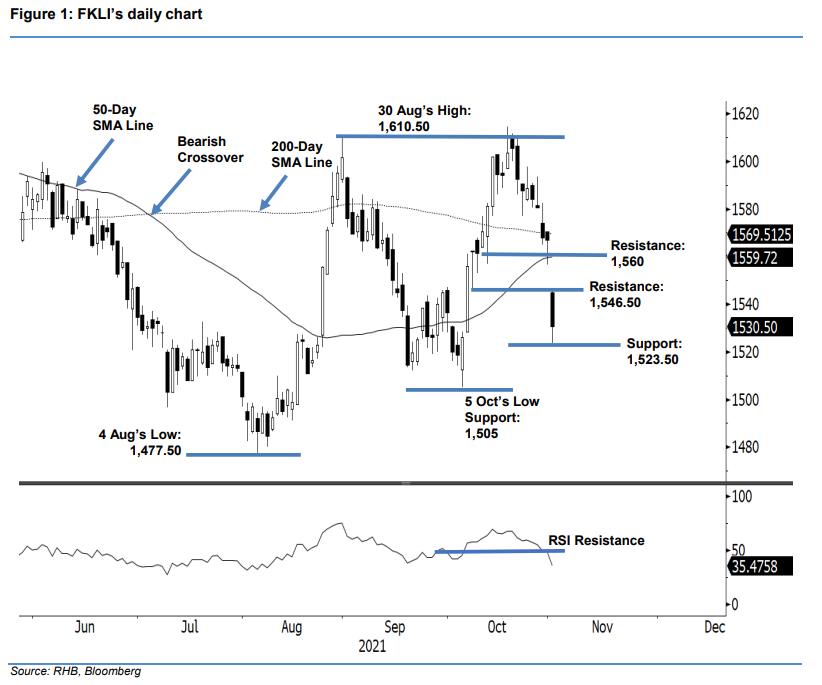

FKLI: Breaching Below The 50-Day SMA Line

rhboskres

Publish date: Tue, 02 Nov 2021, 08:47 AM

Maintain short positions. The FKLI extended its downtrend for the fifth consecutive session, plunging 32 pts to settle at 1,530.50 pts. On the first trading session of the week, the November futures contract gapped down and opened weaker at 1,545 pts. After the weak opening, the index immediately plunged to test the day’s low of 1,523.50 pts. Although it underwent a strong rebound after reaching the intraday low, eventually, it still drifted lower to a soft close. The latest session shows that the risk-off sentiment has kicked in. This, coupled with the RSI falling below the 50% threshold, may lead to the FKLI undergoing continued bearish pressure in the coming sessions. On the other hand, we do not rule out a technical rebound since the index is moving into oversold territory – and the 50-day SMA line could act as the upside resistance. With the bears still in control, we are keeping to a negative trading bias.

We recommend that traders stick to short positions, initiated at the closing level of 26 Oct, ie 1,584 pts. To mitigate trading risks, the trailing-stop has been fixed at 1,560 pts.

The immediate support has been revised to 1,523.50 pts (1 Nov’s low), followed by 1,505 pts (5 Oct’s low). The immediate resistance is now at 1,546.50 pts or the low of 7 Oct, followed by 1,560 pts.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024