WTI Crude: Bullish Momentum Subdued Below the Recent High

rhboskres

Publish date: Wed, 03 Nov 2021, 05:40 PM

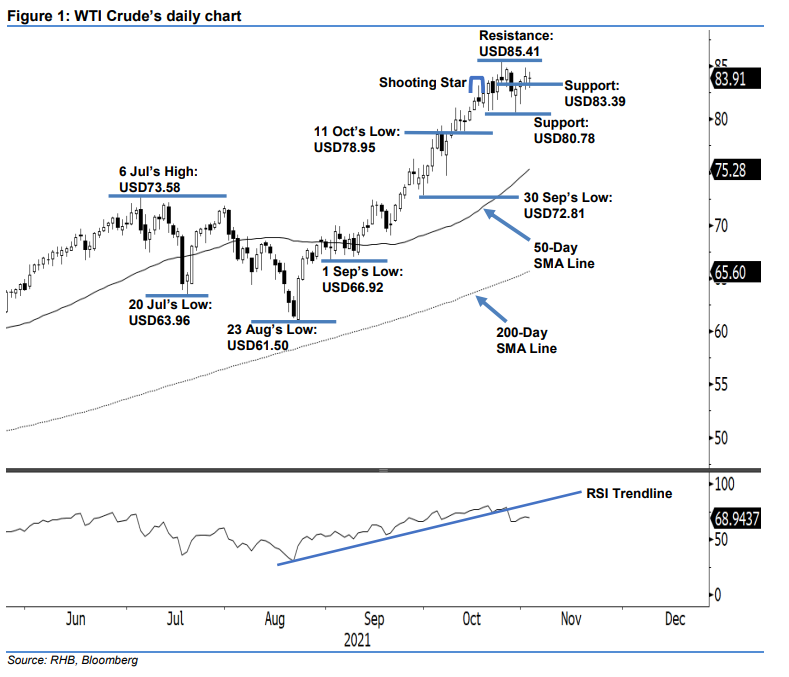

Maintain short positions. The WTI Crude moved sideways above the immediate support yesterday as it settled merely USD0.14 lower at USD83.91 – a neutral tone following recent three consecutive days of bullish momentum. It started mildly lower at USD83.87, before surging to hit the day’s high of USD84.41, only to whipsaw downwards to hit the USD82.92 low, and finally bouncing off mildly at the close. Yesterday’s doji candlestick with upper and lower shadows indicates that the buying momentum has been muted – amid the “lower high” bearish structure – which may see the momentum turn bearish in the coming sessions. This is supported by the weakening of the RSI strength below the positive trendline, signalling weak momentum ahead. Hence, we think the bears may re-emerged in the coming sessions. Unless the stop-loss level is triggered, we stay with our negative trading bias.

We recommend traders maintain short positions initiated at USD82.66, or the closing level of 27 Oct. To manage trading risks, the initial stop-loss threshold is placed at USD85.41.

The support levels are located at USD83.39 – 25 Oct’s low – and USD80.78, which was 20 Oct’s low. The resistance levels are set at USD85.41 – 26 Oct’s high – and followed by USD90.00.

Source: RHB Securities Research - 3 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024