COMEX Gold: Moving Horizontally Pending Breakout

rhboskres

Publish date: Wed, 03 Nov 2021, 05:42 PM

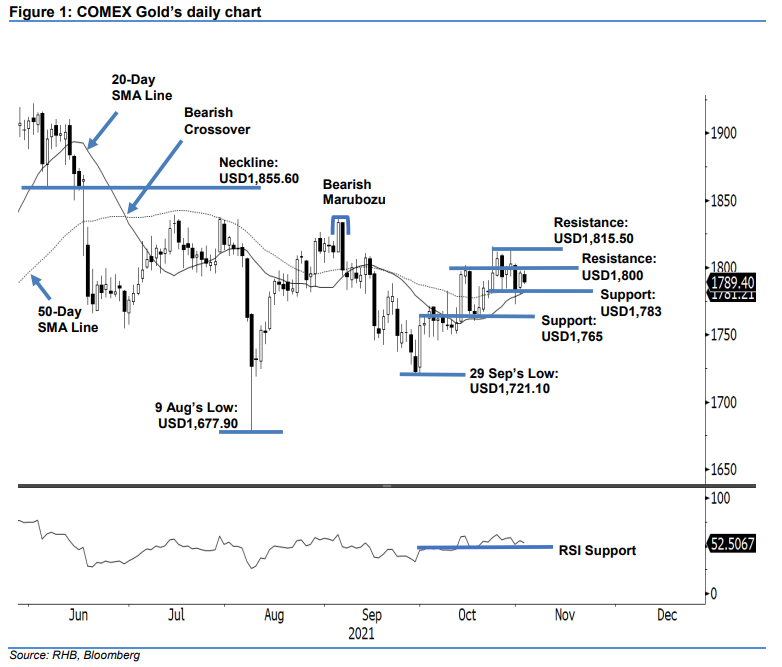

Maintain long positions. The COMEX Gold extended its consolidation along the 50-day SMA line, retracing USD6.40 to settle at USD1,789.40. The commodity started off Tuesday’s session at USD1,794.80. After oscillating between USD1,797.80 and USD1,787.40, the commodity closed at USD1,789.40. At this stage, the commodity is still trading above the 50-day SMA line, and rangebound between USD1,800 and USD1,783. We expect volatility to pick up in the coming sessions and retest the upside resistance. In the event the commodity drops below the 50-day SMA line, this may attract selling pressure to drag it lower. Pending the breakout movement, we stick to our positive trading bias.

Traders should maintain their long positions initiated at USD1,784.90, ie the closing level of 20 Oct. For the trading-risk management, the stop-loss threshold is revised to USD1,780.

The immediate support remains at USD1,783 – 26 Oct’s low – and followed by USD1,765. The first resistance is set at the USD1,800 round figure, followed by the second resistance at USD1,815.50 or 22 Oct’s high.

Source: RHB Securities Research - 3 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024