FKLI: Attempting To Form An Interim Base

rhboskres

Publish date: Wed, 03 Nov 2021, 05:44 PM

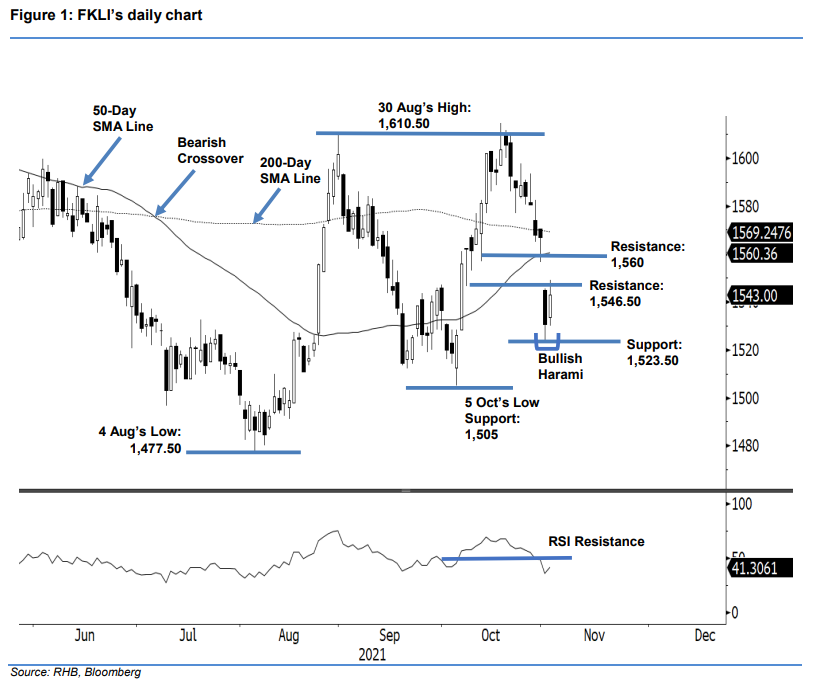

Maintain short positions. After strong selling on Monday, bearish pressure on the FKLI tapered down yesterday, and the index rebounded by 12.50 pts to close at 1,543 pts. It gapped up to open at 1,533.50 pts, then printed the session’s low of 1,530 pts, before turning direction to record the session’s high of 1,549 pts. After testing the intraday high, mild profit-taking activities emerged, and the index pulled back in the afternoon to its close. In the latest session, the FKLI formed an interim base and attempted to stage a technical rebound – forming a Bullish Harami pattern. It needs to push beyond the immediate resistance of 1,546.50 pts, before a bullish reversal can be confirmed. Before this can happen, the index may see a sideways consolidation in the sessions ahead. Until this happens, we maintain a negative trading bias.

Traders should remain in short positions, initiated at 1,584 pts or the closing level of 26 Oct. To control the trading risks, the trailing-stop has been revised to 1,547 pts.

The immediate support is at 1,523.50 pts (1 Nov’s low), followed by 1,505 pts (5 Oct’s low). Towards the upside, the nearest resistance is at 1,546.50 pts or the low of 7 Oct, followed by 1,560 pts.

Source: RHB Securities Research - 3 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024