FCPO: Struggling Near The Resistance Point Of MYR5,000

rhboskres

Publish date: Wed, 03 Nov 2021, 05:44 PM

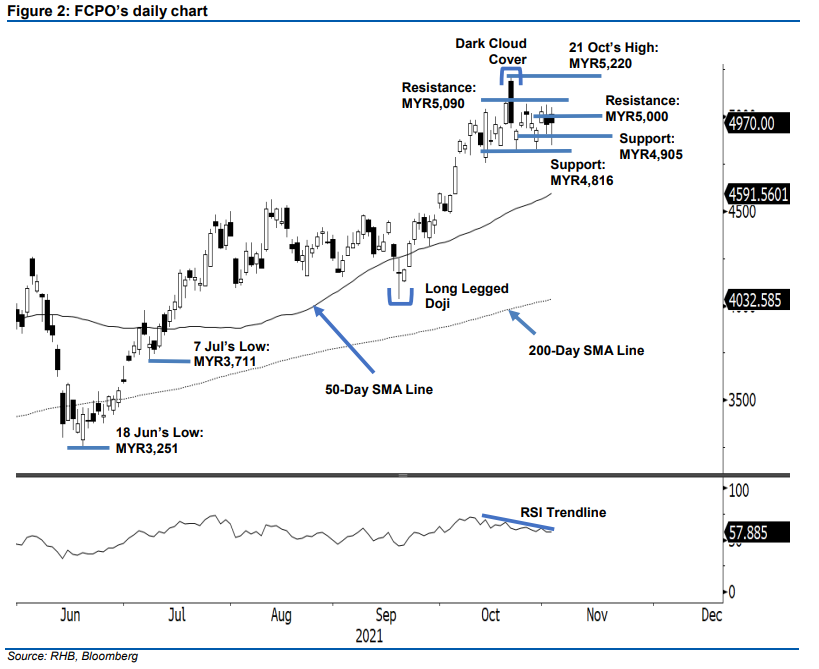

Maintain short positions. Despite the FCPO’s upside movement being capped by the MYR5,000 resistance, it rose MYR9.00 to close at MYR4,970 yesterday. Yesterday, the commodity opened at MYR5,012, but sentiment turned cautious during the early session, and it fell to the session’s low of MYR4,849. It then rebounded in the afternoon, paring down the bulk of intraday losses and closing at MYR4,970 – forming a candlestick with a long lower shadow. The latest price action shows strong buying interest is present at between MYR4,905 and the MYR4,816 support level. Breaching the lower support point of MYR4,816 may mean that the bears are retaking control of the market. Meanwhile, if the FCPO rises above the immediate resistance of MYR5,000, market sentiment may turn positive again. While the commodity is consolidating sideways below the MYR5,000 mark, we maintain a bearish trading bias.

We recommend that traders stick to short positions, which were initiated at MYR4,924 or the close of 22 Oct. To manage trading risks, the stop-loss is at MYR5,030. The nearest support remains at MYR4,905 or the low of 1 Nov, followed by MYR4,816 ie the low of 22 Oct. Conversely, the immediate resistance would be the MYR5,000 psychological mark, then MYR5,090 or the high of 20 Oct.

Source: RHB Securities Research - 2 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024