FCPO: Breaking Past The MYR5,000 Mark

rhboskres

Publish date: Fri, 05 Nov 2021, 04:56 PM

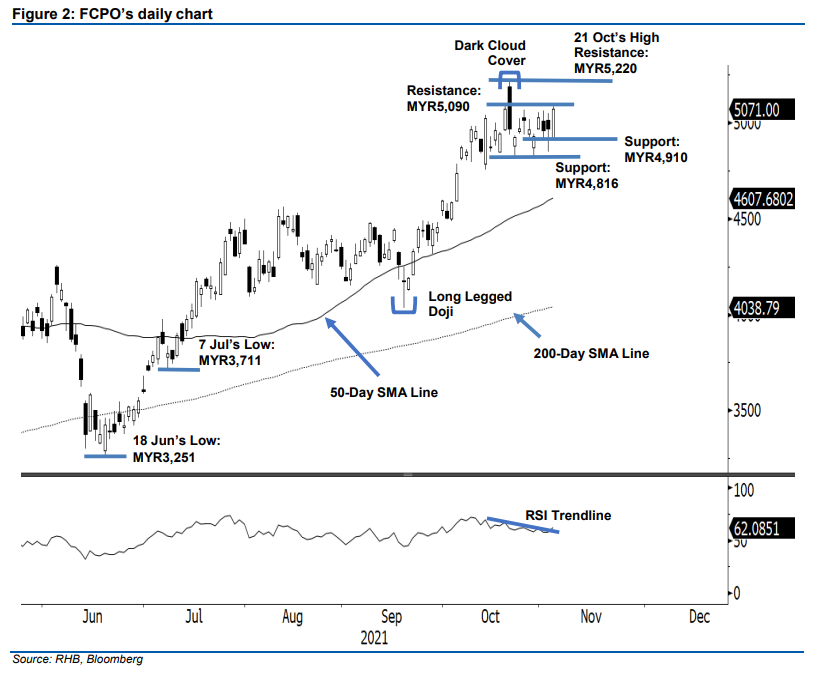

Stop-loss level triggered; initiate long positions. The FCPO saw strong bullish momentum emerging during Wednesday’s session, surging MYR101.00 to settle at MYR5,071. The commodity initially started the session weaker, gapping down and opening at MYR4,920. After it formed the intraday low at MYR4,910, the tide changed and lifted prices higher. The FCPO broke past the MYR5,000 threshold and touched the MYR5,086 session high before closing stronger at MYR5,071. The latest session saw sentiment turning positive after the commodity broke past the psychological level. As the RSI is rounding up, we expect a follow-through momentum to test the MYR5,090 immediate resistance. In the event the bears decide to take profit, expect MYR5,000 to act as strong support. Since the FCPO is resuming its upward movement, we shift to a positive trading bias.

We closed out the short positions initiated at MYR4,924 – the close of 22 Oct – after the MYR5,030 stop-loss was breached. Conversely, we initiate long positions at the closing level of 3 Nov, ie MYR5,071. To mitigate downside risks, the initial stop-loss threshold is set at MYR4,900.

The nearest support is revised to MYR4,910 or the low of 3 Nov. This is followed by MYR4,816, ie the low of 22 Oct. On the upside, the immediate resistance is eyed at MYR5,090 – 20 Oct’s high – and followed by the MYR5,220 all-time high.

Source: RHB Securities Research - 5 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024