COMEX Gold: Volatility Picking Up

rhboskres

Publish date: Fri, 05 Nov 2021, 04:58 PM

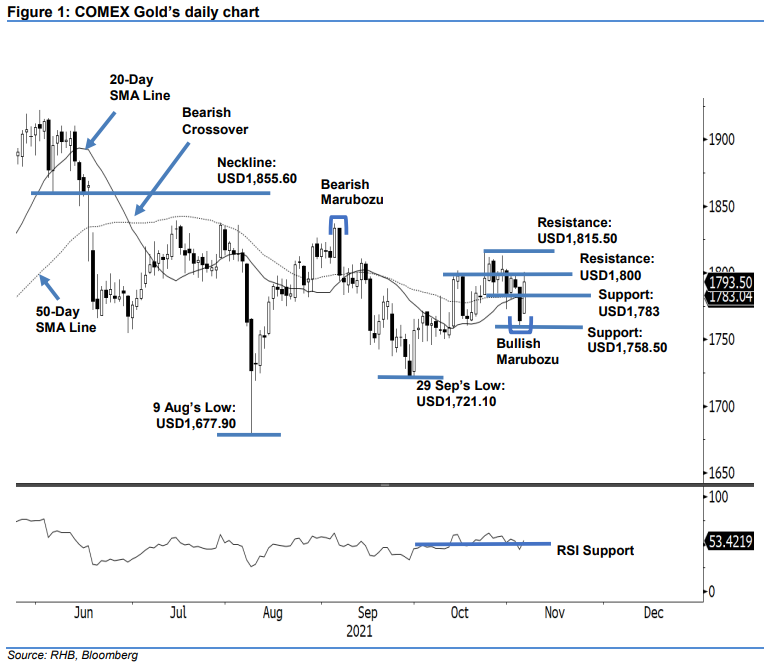

Initiate long positions. The COMEX Gold turned volatile yesterday, surging USD29.60 to settle at USD1,793.50. We observed the commodity initially breaching below the previous USD1,783 on 3 Nov – it fell to the USD1,758.50 low. However, the COMEX Gold experienced strong buying interest on 4 Nov, climbing back above USD1,783 – it closed at USD1,793.50. We deem this as a false breakout at the USD1,783 level and, as such, the support remains intact. Furthermore, the latest session also negated the previous bearish candlestick with Bullish Marubozu. At this stage, the COMEX Gold has managed to stay above the 20-day SMA line – we have also seen this SMA line crossing above the 50-day one. With the latest bullish price action, we expect the commodity to ride on the follow-through momentum to test the USD1,800 psychological level. Hence, we have a positive trading bias.

We recommend traders to keep long positions initiated at USD1,793.50, ie the closing level of 4 Nov. For trading-risk management, the initial stop-loss level is placed at USD1,775.

The immediate support is marked at USD1,783 – 26 Oct’s low – and followed by USD1,758.50, ie the low of 3 Nov. The nearest resistance is sighted at the USD1,800 round figure and followed by the second resistance at USD1,815.50, or 22 Oct’s high.

Source: RHB Securities Research - 5 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024