WTI Crude: Falling Below the USD80.00 Psychological Threshold

rhboskres

Publish date: Fri, 05 Nov 2021, 04:59 PM

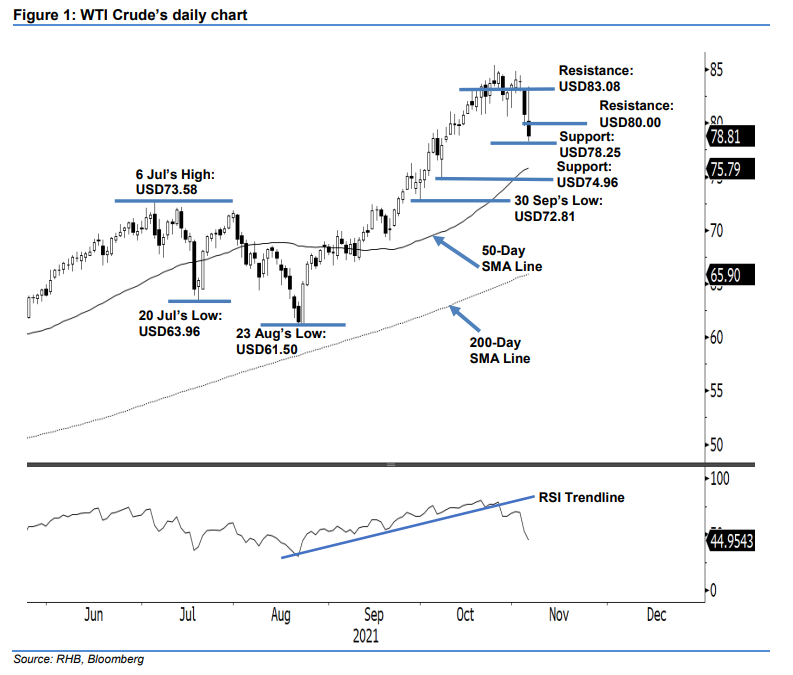

Maintain short positions. The WTI Crude saw selling pressure heightened in the recent two sessions. Yesterday, it declined USD2.05 to close weaker at USD78.81. The commodity started off at USD80.18 and during the European trading hour, it climbed higher to test the intraday high of USD83.42. However, the bulls shied away going into the US trading session, causing the commodity plunge to the day’s low of USD78.25, before closing weaker at USD78.81 and registering a back-to-back bearish session. The latest session confirmed the bears still in control and the commodity is on track for downside correction. If selling pressure continues, the commodity may breach its minor support of USD78.25 and drift lower to test the USD74.96 level. Since the RSI has dropped below the 50% level, it is very unlikely the commodity will climb back above the USD80.00 level in the immediate term. As such, we stick to our negative trading bias.

We recommend traders maintain short positions initiated at USD82.66, or the closing level of 27 Oct. To manage trading risks, the stop-loss threshold is adjusted to USD83.50.

The support levels are marked at USD78.25 – 4 Nov’s low – and USD74.96, which was 7 Oct’s low. The resistance levels are set at the USD80.00 round figure, and followed by USD83.08.

Source: RHB Securities Research - 5 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024