FCPO: Retreating Below The MYR5,000 Threshold

rhboskres

Publish date: Mon, 08 Nov 2021, 09:00 AM

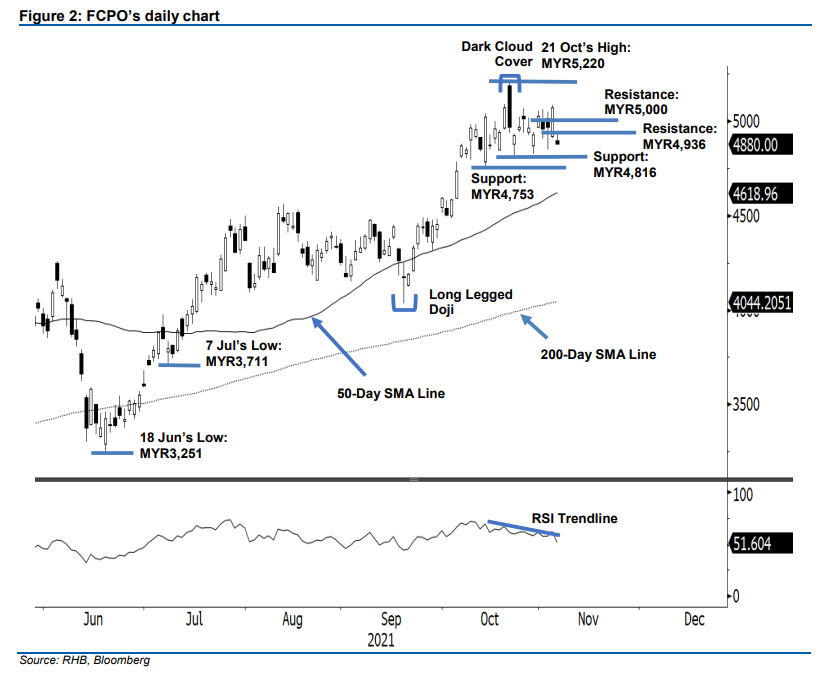

Stop-loss level triggered; initiate short positions. The FCPO failed to stay above the MYR5,000 mark, shedding MYR191.00 to close at MYR4,880. Despite a bullish session last Wednesday, the commodity opened on a weaker note last Friday, gapping down at MYR4,900. Also, the bulls shied away from the market. The commodity merely touched the intraday high of MYR4,936, before correcting to the day’s low of MYR4,877 and closing at MYR4,880. The latest session showed that market sentiment has turned negative again. Coupled with the RSI rounding down, the FCPO is likely to see the negative momentum following through to test the MYR4,816 point. Breaching the immediate support would lead to a further correction towards the lower support of MYR4,753. As long as the FCPO stays below MYR5,000, we will maintain a negative trading bias.

We closed out the long positions initiated at MYR5,071 – the close of 3 Nov – after the MYR4,900 stop-loss was breached. Conversely, we initiate short positions at the closing level of 5 Nov, ie MYR4,880. To manage trading risks, the initial stop-loss threshold is set at MYR5,020.

We revise the nearest support to MYR4,816 (22 Oct’s low) followed by MYR4,753 (13 Oct’s low). Towards the upside, the immediate resistance is at MYR4,936 or the high of 5 Nov, followed by the MYR5,000 psychological barrier.

Source: RHB Securities Research - 8 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024