WTI Crude : Bouncing Off Above the USD80.00 Threshold

rhboskres

Publish date: Mon, 08 Nov 2021, 09:01 AM

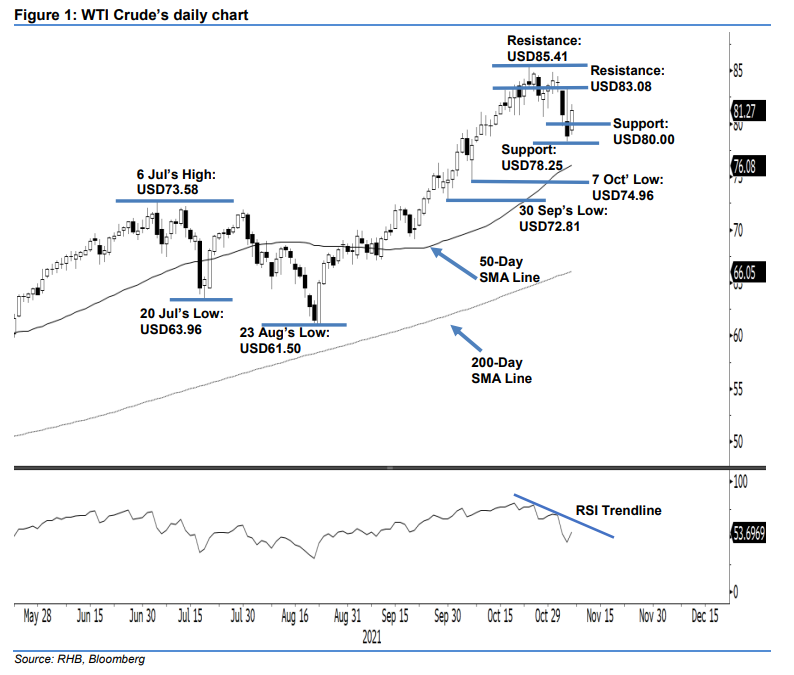

Keep short positions. The WTI Crude paused its recent bearish momentum by bouncing off moderately last Friday and climbing USD2.46 to close at USD81.27 – still far away from the stop-loss threshold of USD83.50. Last Friday, it opened higher at USD79.37 and whipsawed in a sideways direction until the starting of the US trading session where it touched the day’s low of USD78.96. It then moved beyond the intraday sideways consolidation phase and propelled towards the intraday high of USD81.80 prior to settling at USD81.27. The latest session’s bullish candlestick amid the “lower high” bearish pattern suggests that the positive rebound is still premature and is expected to be shortlived in the medium term. This is supported by the RSI strength that has bounced off above the 50% level but remains below the negative trendline. Unless the stop-loss level is breached, we keep to our negative trading bias.

We suggest traders maintain short positions initiated at USD82.66, or the closing level of 27 Oct. To manage trading risks, the stop-loss threshold is set at USD83.50.

The support levels are marked at the USD80.00 round figure, and USD78.25, which was 4 Nov’s low. The resistance levels are set at USD83.08, and followed by USD85.41 – 25 Oct’s high.

Source: RHB Securities Research - 8 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024