FCPO: Struggling To Break The Immediate Support

rhboskres

Publish date: Tue, 09 Nov 2021, 08:37 AM

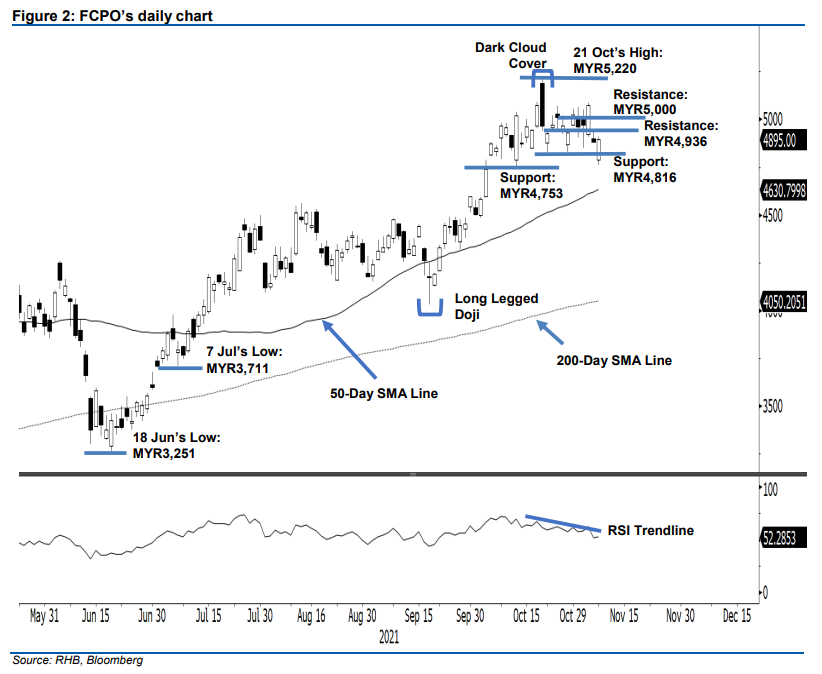

Keep short positions. Despite opening significantly lower, the FCPO managed to recoup all the intraday losses to close MYR15.00 higher at MYR4,895 – it closed above the immediate support level despite opening below it. The commodity initially opened weaker yesterday, gapping down at MYR4,790 before printing the day’s low of MYR4,761. Following that, buying momentum kicked in and turned the direction northwards. Buying pressure then persisted until the end of the session. The FCPO hit the day’s high of MYR4,910 before closing. The latest session showed that the recent negative market sentiment took a pause yesterday, with the long white candlestick situated above the immediate support level. However, a change of direction would be anticipated if the commodity pushes up beyond the MYR5,000 threshold. In line with the RSI struggling below the negative trendline, the FCPO is likely to see negative momentum following through to retest the MYR4,816 support. As such, we maintain a negative trading bias until the stop-loss level has been breached.

We recommend that traders remain in short positions, initiated at MYR4,880 or the closing level of 5 Nov. To manage trading risks, the initial stop-loss threshold is pegged at MYR5,000.

We set the nearest support at MYR4,816 (22 Oct’s low), followed by MYR4,753 (13 Oct’s low). Towards the upside, the immediate resistance is at MYR4,936 or the high of 5 Nov, followed by the MYR5,000 psychological barrier.

Source: RHB Securities Research - 8 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024