FKLI: Bouncing Off Mildly

rhboskres

Publish date: Tue, 09 Nov 2021, 08:37 AM

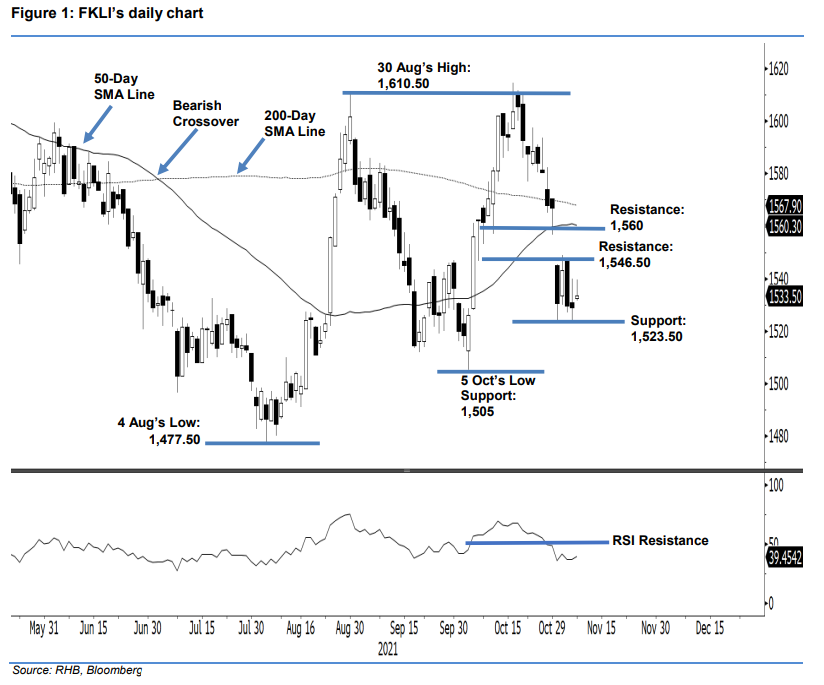

Maintain short positions. The FKLI jumped higher yesterday despite strong intraday profit-taking from the peak. It closed 4.5 pts higher, at 1,533.5 pts. The index opened at 1,532.5 pts, then propelled towards the intraday high of 1,539.5 pts. Then, profit-taking kicked in throughout the session, and brought the FKLI to the session’s low of 1,531.5 pts before closing. The long upper shadow candlestick, formed within the “lower low” bearish pattern, indicates that the bears are still in control – in line with the RSI movement being within the oversold territory. This echoed with our expectation that the index will be rangebound, between 1,546.50 pts and 1,523.50 pts. Until the trailing-stop is breached, we stick to a negative trading bias.

Traders should stay in short positions, initiated at 1,584 pts or the closing level of 26 Oct. To mitigate trading risks, the trailing-stop threshold has been set at 1,547 pts.

The immediate support is at 1,523.50 pts – 1 Nov’s low – then 1,505 pts or 5 Oct’s low. Meanwhile, the first resistance is set at 1,546.50 pts or 3 Nov’s high, then 1,560 pts.

Source: RHB Securities Research - 9 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024