E-Mini Dow: Inching Higher Into Uncharted Territory

rhboskres

Publish date: Tue, 09 Nov 2021, 08:57 AM

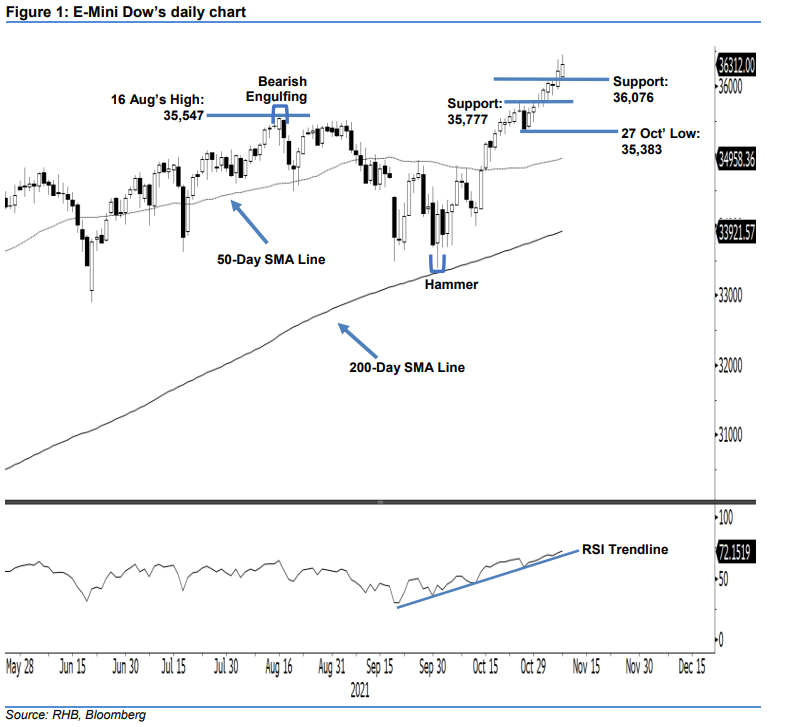

Maintain long positions. The E-Mini Dow began the week with bullish momentum, climbing 97 pts to close at 36,312 pts, despite starting the session lower. The index opened at 36,132 pts yesterday, and touched the day’s low of 36,123 pts. Buying pressure then emerged to move it higher, after which, it oscillated sideways. After the European trading session, the E-Mini Dow resumed its uptrend strongly, into the early part of the US trading session – hitting the day’s high of 36,446 pts. Strong profit-taking then occurred, before the index bounced off moderately to close. The latest bullish candlestick with upper shadow indicates that uptrend momentum may be paused for a mild pullback in the next session, as the RSI is still in 70% overbought territory. Until the momentum reverses and the stop-loss is breached, we stick to our bullish trading bias.

Traders should keep to the long positions initiated at 35,800 pts, or the closing level of 1 Nov. To manage trading risks, the initial stop-loss threshold is set at 35,777 pts.

The immediate support is fixed at 36,076 pts (4 Nov’s high), followed by 35,777 pts – 26 Oct’s high. Meanwhile, the immediate resistance is pegged at 36,500 pts – the high of 4 Nov – followed by 37,000 pts

Source: RHB Securities Research - 9 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024