COMEX Gold: Eyeing to Test the Immediate Resistance

rhboskres

Publish date: Wed, 10 Nov 2021, 06:59 PM

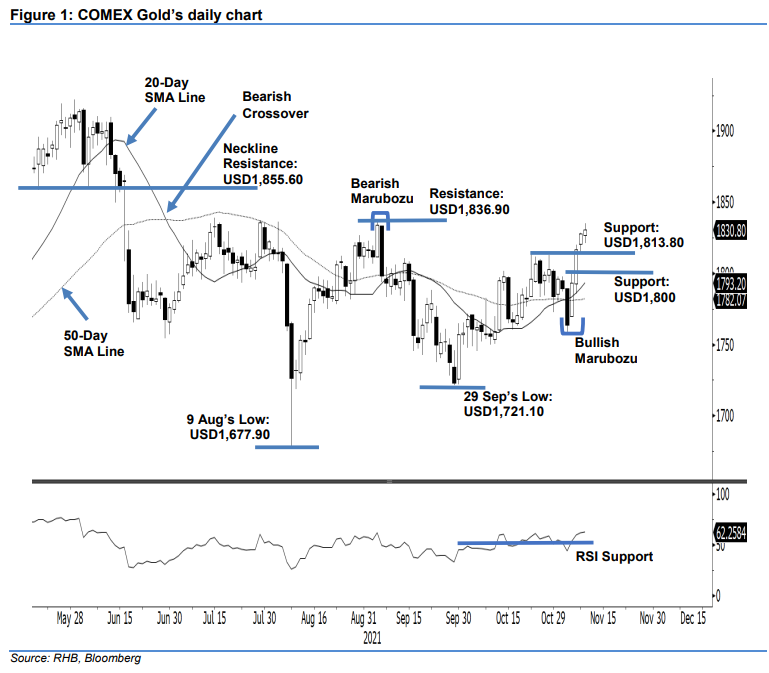

Maintain long positions. The COMEX Gold stay on its upward trajectory yesterday, rising USD2.80 to settle at USD1,830.80. Initially, the commodity opened weaker at USD1,826.90 and dipped to the day’s low of USD1,821. However, strong buying interest emerged again during the US trading session, lifting the commodity higher towards the day’s high of USD1,834.80 and closing stronger at USD1,830.80. The commodity has maintained its uptrend posture by printing a fresh ‘higher high with higher low” pattern, and is now eyeing to test the immediate resistance pegged at USD1,836.90. Breaching the strong resistance will attract further buying pressure to send the commodity higher. Meanwhile, the COMEX Gold has become firmer above the USD1,800 psychological level. For the immediate term, we think the upside risk remains and hence, retain our positive trading bias.

Traders should hold on to the long positions initiated at USD1,793.50, ie the closing level of 4 Nov. To mitigate downside risks, the stop-loss level is placed at USD1,775.

The nearest support is marked at USD1,813.80, the low of 8 Nov, followed by the USD1,800 round number. Meanwhile, the immediate resistance is sighted at USD1,836.90 – 3 Sep’s high – followed by the neckline USD1,855.60.

Source: RHB Securities Research - 10 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024