WTI Crude: Strongly Rebounding Higher

rhboskres

Publish date: Wed, 10 Nov 2021, 07:00 PM

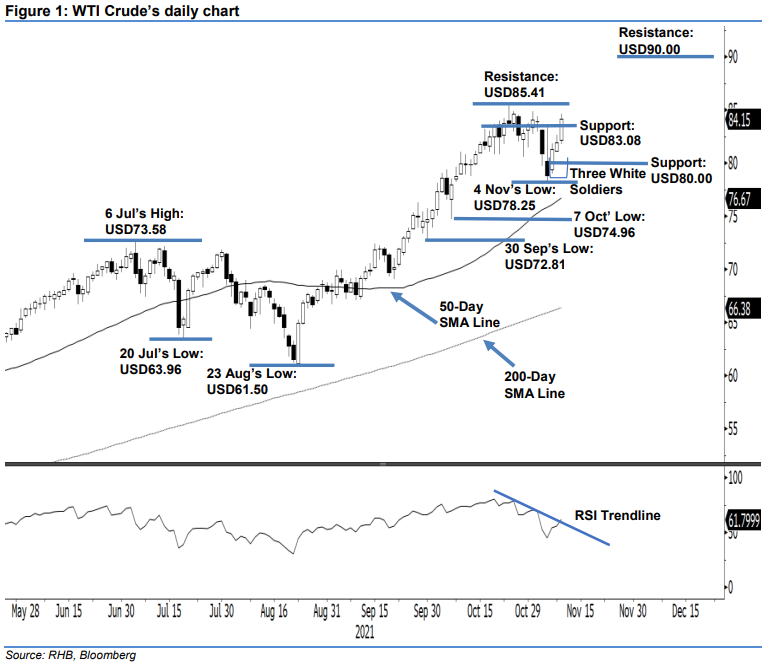

Stop-loss triggered; initiate long positions. The WTI Crude continued its bullish momentum for the third consecutive session yesterday, as it rose USD2.22 to settle at USD84.15 – breaching the immediate resistance of USD83.08. It opened at USD82.16 and oscillated sideways to touch the day’s low at USD81.78 before propelling northwards during the US trading session. It hit the day’s peak of USD84.63 before closing. The “Three White Soldiers” candlestick pattern – three white candles, each closing higher than the last – suggests that the bulls are back in the drivers seat, as the commodity formed a higher high. This is in tandem with the improved RSI strength above the 60% region. Since the stop-loss is triggered, we shift to a positive trading bias.

We closed out our short positions initiated at USD82.66, or the closing level of 27 Oct, after the stop-loss mark at USD83.50 was triggered. Conversely, we initiate long positions at the closing level of 9 Nov, ie USD84.15. To manage trading risks, the intital stop-loss threshold is placed below the USD80.00 level.

The support levels are adjusted to USD83.08, and the USD80.00 round figure. The nearest resistance level is set at USD85.41 – 25 Oct’s high, followed by USD90.00.

Source: RHB Securities Research - 10 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024