FCPO: Attempting To Build An Interim Base

rhboskres

Publish date: Wed, 10 Nov 2021, 07:03 PM

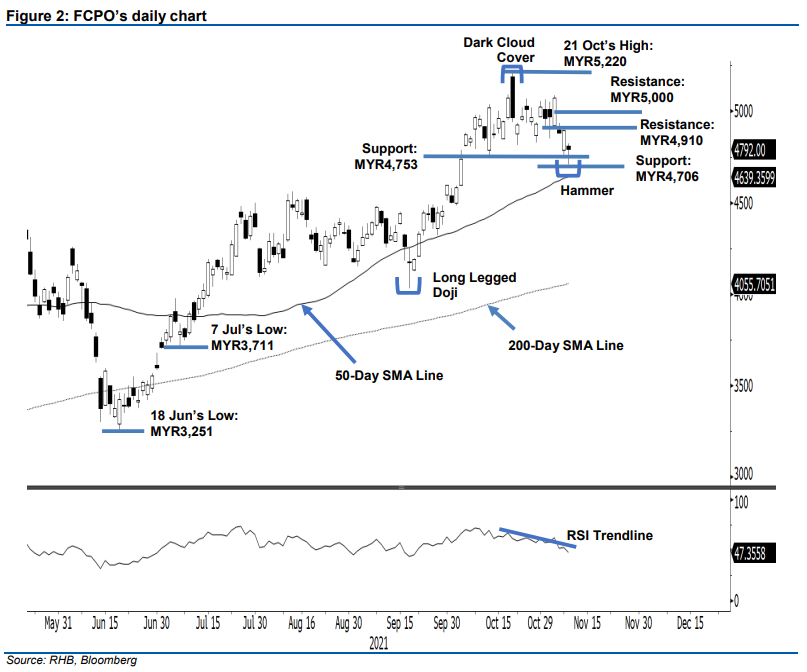

Maintain short positions. Yesterday, the FCPO erased gains from the previous session and sank by MYR103.00 to close at MYR4,792. The commodity gapped down at the open yesterday, at MYR4,812. Selling pressure during the early session dragged it to the session’s low of MYR4,706. The tide changed after buying interest emerged during the late afternoon, paring intraday losses and lifted the commodity up to close at MYR4,792. Although the FCPO printed a Hammer candlestick pattern near the support level, the commodity still charted a “lower high” bearish pattern recently. After forming the Hammer pattern, the commodity may undergo a technical rebound. However, we expect the MYR4,910 level to bring strong selling pressure. As long as the commodity stays below the MYR5,000 mark, we make no change to our negative trading bias.

We recommend that traders stay in short positions, initiated at MYR4,880 or the closing level of 5 Nov. To manage trading risks, the initial stop-loss has been set at MYR5,000.

The immediate support has been changed to MYR4,753 (13 Oct’s low) followed by MYR4,706 (9 Nov’s low). Towards the upside, the immediate resistance is pegged at MYR4,910 or the high of 8 Nov, followed by the MYR5,000 psychological level.

Source: RHB Securities Research - 10 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024