FKLI: Negative Momentum Persists

rhboskres

Publish date: Wed, 10 Nov 2021, 07:03 PM

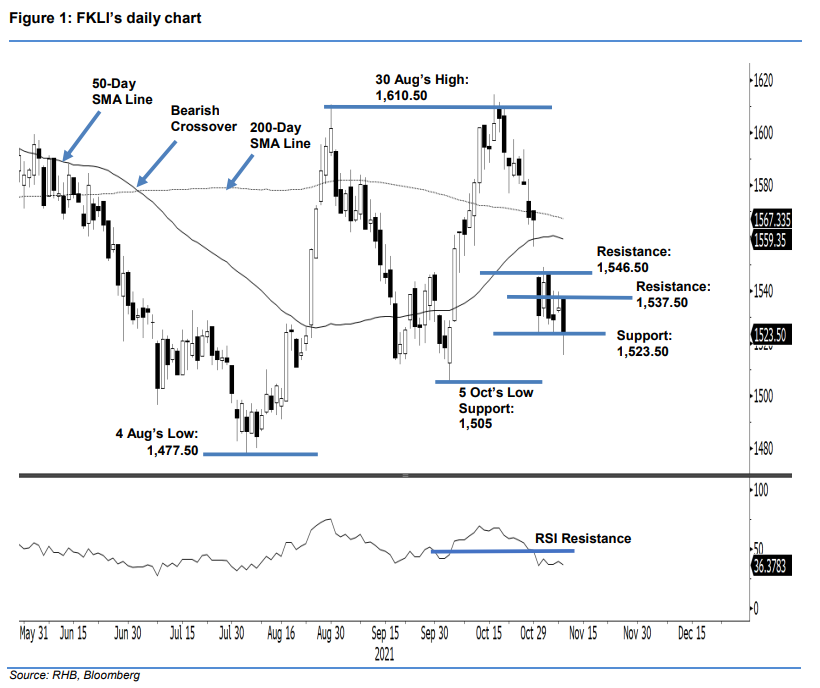

Maintain short positions. Selling pressure on the FKLI ramped up yesterday, and the index shed 10 pts to close at 1,523.5 pts. It opened higher at 1,537 pts and touched the intraday high of 1,537.50 pts. The strong opening failed to spur it on further, and bears took profit near the session’s high – pulling the FKLI down to the day’s low of 1,515.50 pts before the close. The latest session confirms the weak market sentiment, and we may see another leg-down testing October’s low of 1,505 pts. However, the bulls are not giving up yet, and are putting up a fight near the support level of 1,523.50 pts. With the RSI falling into oversold territory, the index may enter a technical rebound to retest 1,537.50 pts, before falling lower. As downside risks prevail, we make no change to our negative trading bias.

Traders should stick to short positions, initiated at 1,584 pts or the closing level of 26 Oct. To limit the trading risks, the trailing-stop threshold has been fixed at 1,547 pts.

The immediate support remains at 1,523.50 pts (1 Nov’s low) followed by 1,505 pts (5 Oct’s low). On the other hand, the resistance is pegged at 1,537.50 pts or the high of 9 Nov, then at 1,546.50 pts or 3 Nov’s high.

Source: RHB Securities Research - 9 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024