FKLI: Falling Below Immediate Support

rhboskres

Publish date: Thu, 11 Nov 2021, 05:11 PM

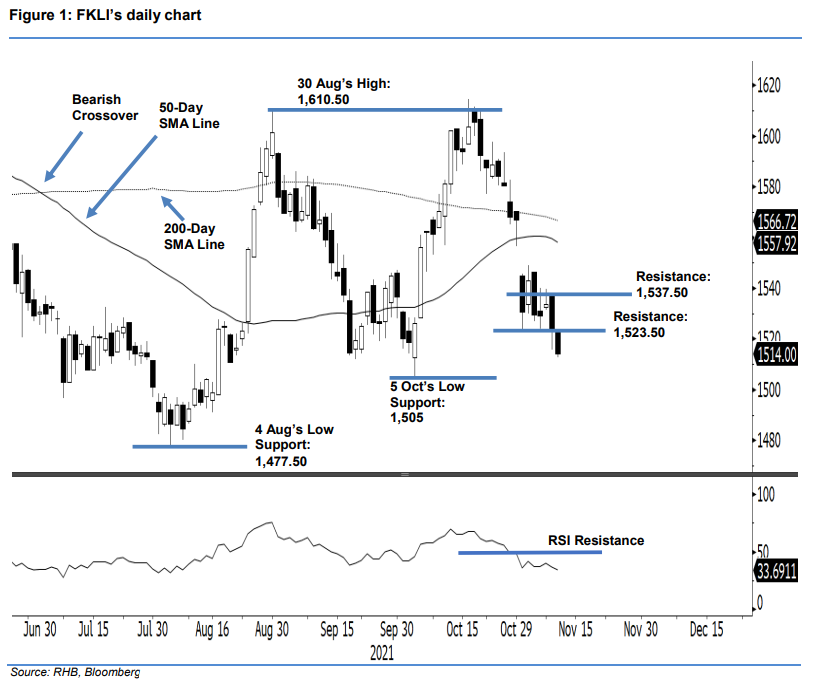

Maintain short positions. Bearish pressure on the FKLI persisted yesterday, and the index closed 9.5 pts lower at 1,514 pts – breaching the nearest support of 1,523.5 pts. It opened at 1,523.5 pts (the day’s high), then headed south to the intraday low of 1,512.50 pts in the early session. The FKLI then bounced off mildly and oscillated towards the close, just above the intraday low. The latest black body candlestick shows that the bears are picking up pace, as the index fell past the immediate support – it may decline further towards October’s low of 1,505 pts. This is in line with the further weakening of the RSI towards the 30% level. With the downside risks becoming more visible, we make no change to our negative trading bias.

Traders should keep to short positions, initiated at 1,584 pts or the closing level of 26 Oct. To limit the trading risks, the trailing-stop threshold is at 1,547 pts.

The immediate support has been adjusted to 1,505 pts (5 Oct’s low), followed by 1,477.5 pts (4 Aug’s low). On the other hand, the resistance is pegged at 1,523.50 pts or the low of 1 Nov, then at 1,537.50 pts or 9 Nov’s high.

Source: RHB Securities Research - 11 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024