FCPO: Bouncing Off From The Interim Base

rhboskres

Publish date: Thu, 11 Nov 2021, 05:12 PM

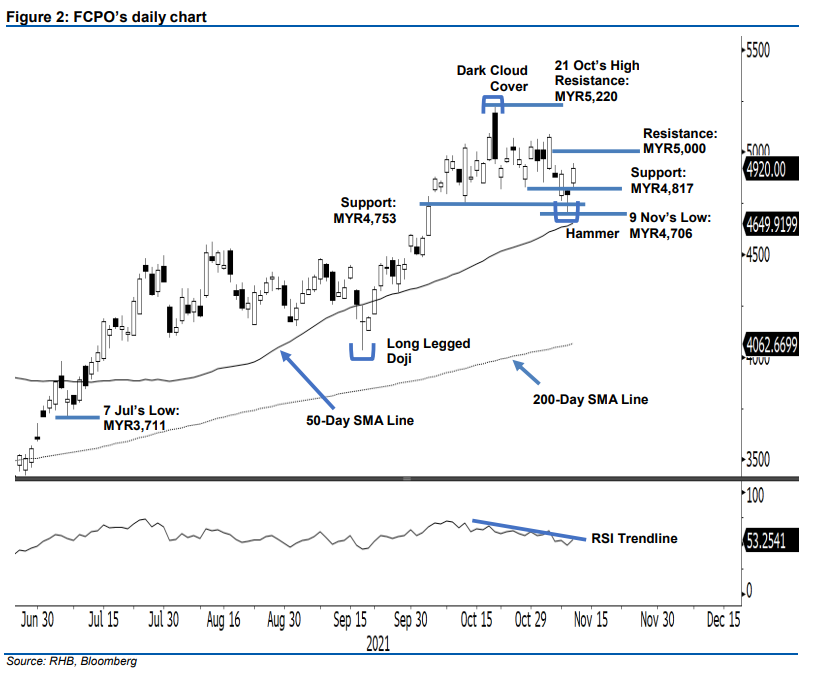

Maintain short positions. Yesterday, the FCPO added MYR128.00 to close at MYR4,920 – which is still below the stop-loss level of MYR5,000. The commodity gapped up at the open yesterday at MYR4,849, then retraced mildly immediately towards the day’s low of MYR4,817 before rebounding gradually towards the close. It hit the day’s peak of MYR4,945 before closing. The latest bullish candlestick – following the Hammer candlestick pattern formed earlier – indicates that the commodity is likely to continue its rebound towards the MYR5,000 threshold. However, we expect the MYR5,000 level to bring about strong selling pressure. Until it breaches the MYR5,000 mark, we make no change to our negative trading bias.

We recommend that traders stay in short positions, initiated at MYR4,880 or the closing level of 5 Nov. To manage trading risks, the initial stop-loss has been set at MYR5,000.

The immediate support is pegged at MYR4,817 (10 Nov’s high) followed by MYR4,753 (13 Oct’s low). Towards the upside, the immediate resistance is at the psychological level of MYR5,000, followed by the MYR5,220 or 21 Oct’s high.

Source: RHB Securities Research - 11 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024