E-Mini Dow: Bears Take the Lead

rhboskres

Publish date: Thu, 11 Nov 2021, 05:17 PM

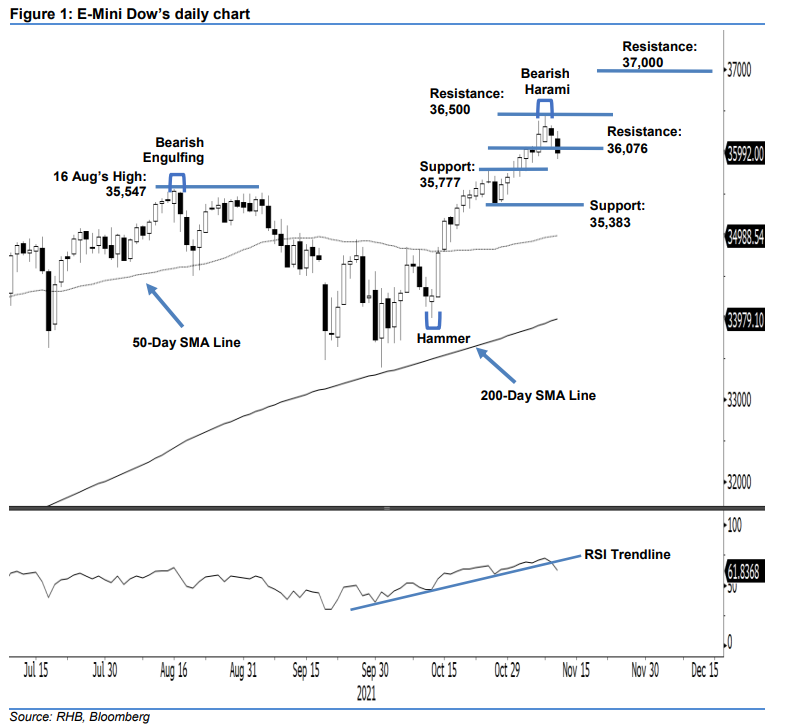

Trailing-stop triggered; initiate short positions. The E-Mini Dow displayed strong selling pressure yesterday, after falling 217 pts to close at 35,992 pts, and breaching below the immediate support. The index opened lower at 36,166 pts, and moved in a highly volatile fashion throughout the session. It whipsawed in an upward direction towards the early US trading session to hit the day’s high of 36,255 pts. However, the positive momentum did not last – instead, it swiftly headed south to plunge to the day’s low of 35,911 pts before rebounding moderately to close at 35,992 pts. The latest black body candlestick below the immediate support-turned-resistance level of 36,076 pts signals the bearish momentum is getting more obvious – in tandem with our earlier expectations. Since the trailing-stop has been breached, we switch to a bearish trading bias.

We closed out our long positions initiated at 35,800 pts, or the closing level of 1 Nov, after the trailing-stop mark at 36,076 pts was triggered. Conversely, we initiate short positions at the closing level of 10 Nov, ie 35,992 pts. To manage trading risks, the initial stop-loss threshold is set at 36,500 pts.

The immediate support is located at 35,777 pts (26 Oct’s high), followed by 35,383 pts – 27 Oct’s low. Meanwhile, the immediate resistance is set at 36,076 pts – the high of 4 Nov – followed by 36,500 pts.

Source: RHB Securities Research - 11 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024