WTI Crude: Strong Selling Pressure Re-Emerges

rhboskres

Publish date: Thu, 11 Nov 2021, 05:17 PM

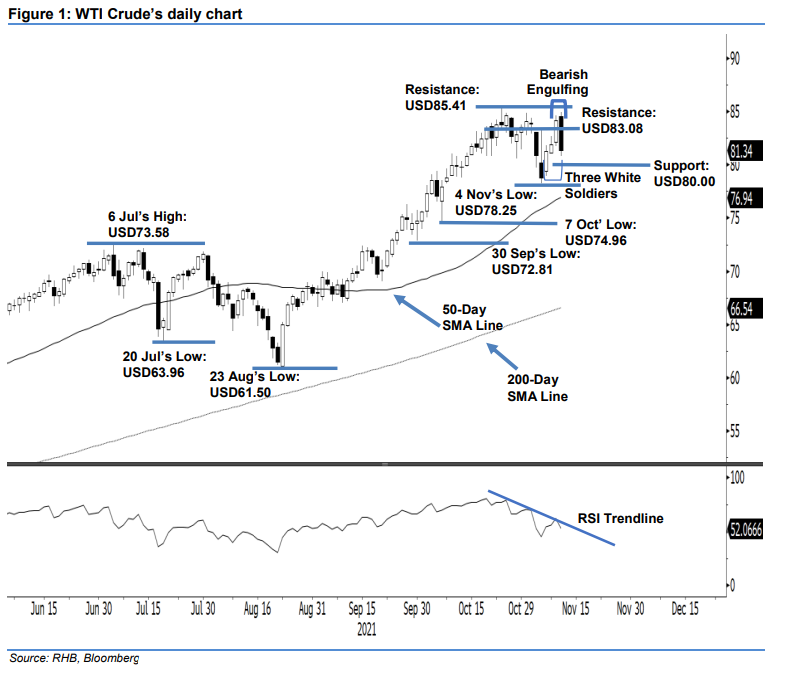

Still long positions. The WTI Crude reversed its recent positive momentum to head downwards, as it fell USD2.81 to settle at USD81.34 – breaching below the immediate support of USD83.08. It opened on a positive tone at USD84.53 to merely touch the day’s high at USD84.97 before gradually moving lower towards the end of the session. Strong selling pressure emerged during the early US trading session to drag the WTI towards the day’s bottom at USD80.81 before bouncing off mildly to close beneath yesterday’s low. The “Bearish Engulfing” candlestick pattern – a white candlestick followed by a large black candlestick from the top – indicates strong selling pressure has re-emerged following the recent uptrend rebound. Hence, expect volatility to persist in the coming sessons between the USD83.08 resistance and USD80.00 support. Until the stop-loss is triggered, we are keeping our positive trading bias.

We recommend traders to maintain long positions initiated at USD84.15 – the closing level of 9 Nov. To manage trading risks, the intital stop-loss level is set below the USD80.00 level.

The support levels are adjusted to USD80.00, and the USD78.25 – 4 Nov’s low. The nearest resistance level is set at USD83.08, followed by USD85.41 – 25 Oct’s high.

Source: RHB Securities Research - 11 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024