COMEX Gold: Attempting to Breach the Immediate Resistance

rhboskres

Publish date: Fri, 12 Nov 2021, 04:22 PM

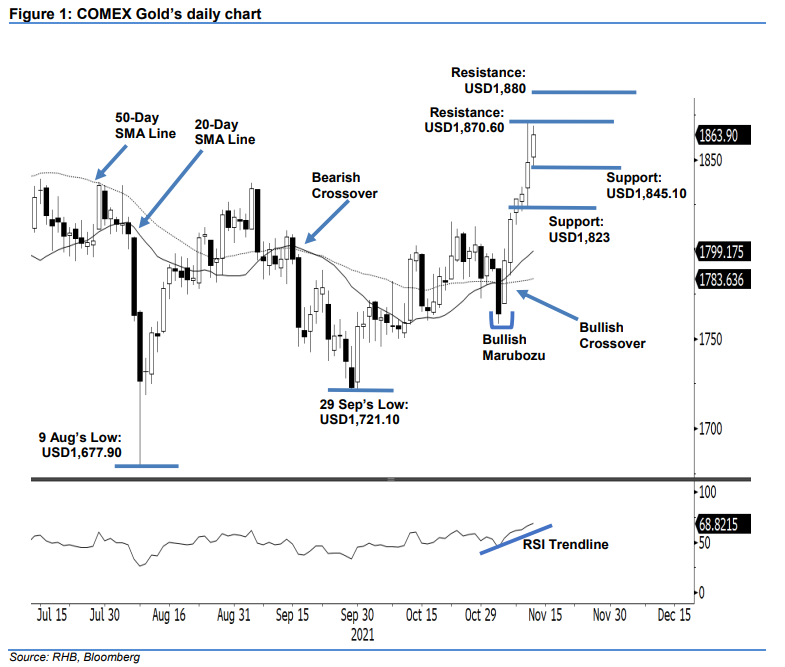

Maintain long positions. The COMEX Gold stayed on its upward trajectory, adding USD15.60 to settle at USD1,863.90. The yellow metal started off Thursday’s session stronger, gapping up and opening at USD1,851.50. After it established the day’s low at USD1,845.10, the commodity climbed towards the day’s high of USD1,868.70 and closed at USD1,863.90. The bulls are firmly in control of the session and eyeing to cross the USD1,870.60 immediate resistance. Despite the RSI heading into an overbought territory, the bullish momentum is not showing any signs of fatigue yet. In the event the bears take profits, USD1,845.10 will lend an immediate support. Since the bullish momentum is intact now, we believe there is still another leg on the upside and make no change to our positive trading bias.

We recommend traders hold on to their long positions initiated at USD1,793.50 or the closing level of 4 Nov. To protect downside risks, the trailing-stop is adjusted higher to USD1,835.

The nearest support is situated at USD1,845.10 – 11 Nov’s low – followed by USD1,823, the low of 10 Nov. The immediate resistance is eyed at USD1,870.60 – 10 Nov’s high – then the higher hurdle projected at USD1,880.

Source: RHB Securities Research - 12 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024