E-Mini Dow: Profit Taking Strongly Continues

rhboskres

Publish date: Fri, 12 Nov 2021, 04:23 PM

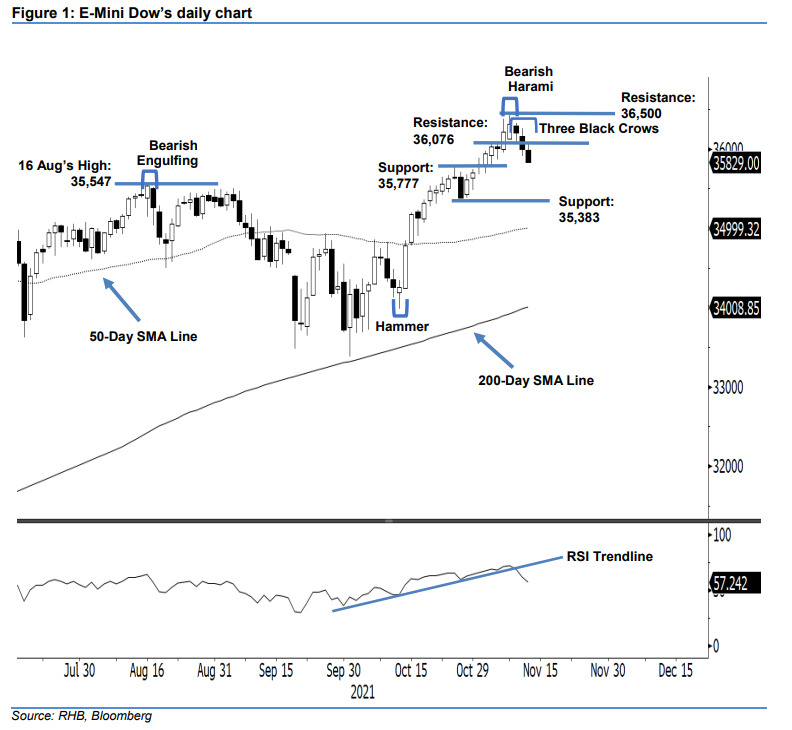

Maintain short positions. The E-Mini Dow continued its selling momentum for the third consecutive session, as it fell 163 pts to close at 35,829 pts yesterday. The index opened slightly lower at 35,982 pts and oscillated sideways before buying momentum kicked in and saw the index hit the intraday high of 36,063 pts during the European trading session, albeit, shortlived. Following the US trading session, selling pressure emerged strongly to write-off all intraday gains and dragged the index towards the day’s bottom of 35,823 pts, just before closing. The three consecutive sessions of black body candlestick – “Three Black Crows” bearish reversal pattern – indicates the bearish pressure is expected to stay in the medium term. However, expect a mild rebound below the 36,500-pt resistance before it continues to drag lower – while forming a “lower high” bearish pattern. This is also supported by a weakening RSI pointing sharply below the 60% level. As such, we are keeping our bearish trading bias, which we shifted to in the previous note.

Traders are suggested to remain in short positions initiated at 35,992 pts – the closing level of 10 Nov. To manage trading risks, the initial stop-loss threshold is pegged at 36,500 pts.

The immediate support is fixed at 35,777 pts (26 Oct’s high), followed by 35,383 pts – 27 Oct’s low. Meanwhile, the immediate resistance is still at 36,076 pts – the high of 4 Nov – followed by 36,500 pts.

Source: RHB Securities Research - 12 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024