WTI Crude: Struggling to Build An Interim Base

rhboskres

Publish date: Fri, 12 Nov 2021, 04:24 PM

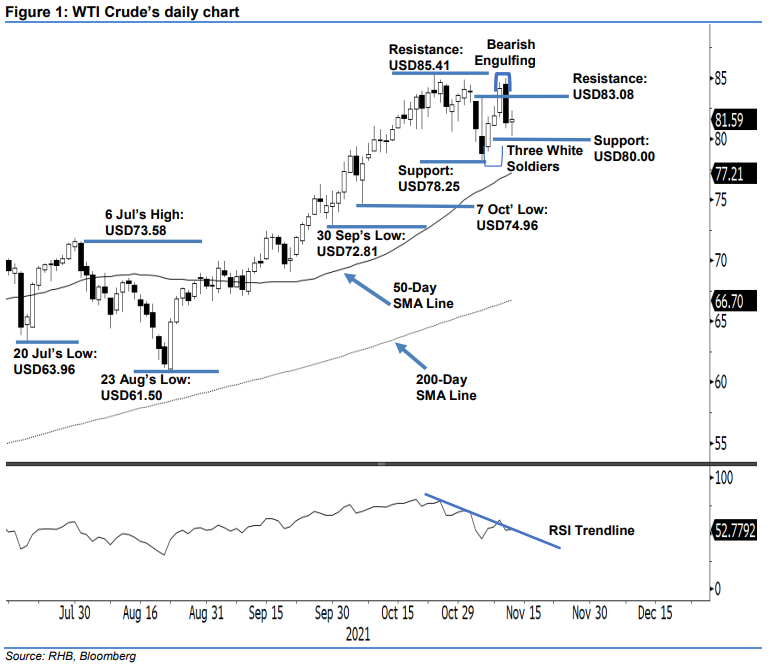

Keep long positions. The WTI Crude attempted to pause the recent bearish momentum yesterday as it bounced off from the intraday low to close USD0.25 higher at USD81.59 – amid a pullback from the intraday high. The commodity moved in a highly volatile fashion, opening at USD81.41 and oscillating sideways ahead of the European trading session. A whipsaw session followed when strong buying momentum emerged to lift the commodity higher before swiftly reversing to hit the day’s low at USD80.20. It then bounced off strongly again – this time higher towards the day’s high of USD82.33 prior to a strong pullback towards the end of the session, closing at USD81.59 – slightly above Wednesday’s close. The neutral candlestick with a long lower shadow yesterday shows the commodity is in the midst of forming an interim base to rebound higher towards the USD83.08 resistance. Unless the bearish momentum re-emerges to trigger the stop-loss, we stick to our positive trading bias.

We recommend traders to stay in the long positions initiated at USD84.15 – the closing level of 9 Nov. To manage trading risks, the intital stop-loss level is set below the USD80.00 level.

The support levels are still at USD80.00, and USD78.25 – 4 Nov’s low. The nearest resistance level is pegged at USD83.08, followed by USD85.41 – 25 Oct’s high.

Source: RHB Securities Research - 12 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024