FCPO: Strong Bearish Pressure Emerge

rhboskres

Publish date: Fri, 12 Nov 2021, 04:26 PM

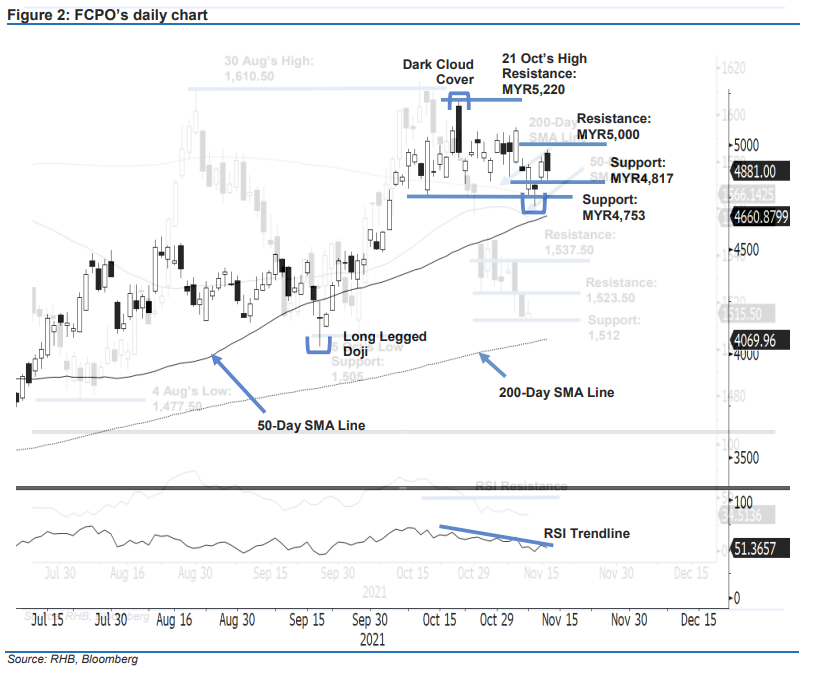

Maintain short positions. Despite the strong momentum in the first half of the trading day, the FCPO saw robust selling activity in the afternoon. It retraced MYR39.00 to close lower, at MYR4,881 – which means that the commodity has yet to break above the psychological resistance of MYR5,000. It initially gapped up and opened at MYR4,964, then grazed the intraday high of MYR4,980 before falling to the day’s low of MYR4,832 in the afternoon. The latest bearish candlestick shows that the bulls are not ready to climb higher, and may consolidate sideways near the immediate support of MYR4,817. Breaching the immediate support will dent market sentiment and lead to a downside correction. On the other hand, if the commodity breaks above the psychological mark, it will march upwards to negate the Dark Cloud Cover which was formed on 21 Oct. At this stage, we maintain that MYR5,000 will act as a strong resistance, and will hold on to a negative trading bias until the stop-loss is breached.

We recommend that traders stick to short positions, initiated at MYR4,880 or the closing level of 5 Nov. To minimise trading risks, the initial stop-loss is set at MYR5,000.

The immediate support remains at MYR4,817 (10 Nov’s high) followed by MYR4,753 (13 Oct’s low). On the upside, the immediate resistance stays at the psychological level of MYR5,000, followed by the MYR5,220 or 21 Oct’s high.

Source: RHB Securities Research - 12 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024