FKLI: Selling Pressure Is Tapering Down

rhboskres

Publish date: Fri, 12 Nov 2021, 04:27 PM

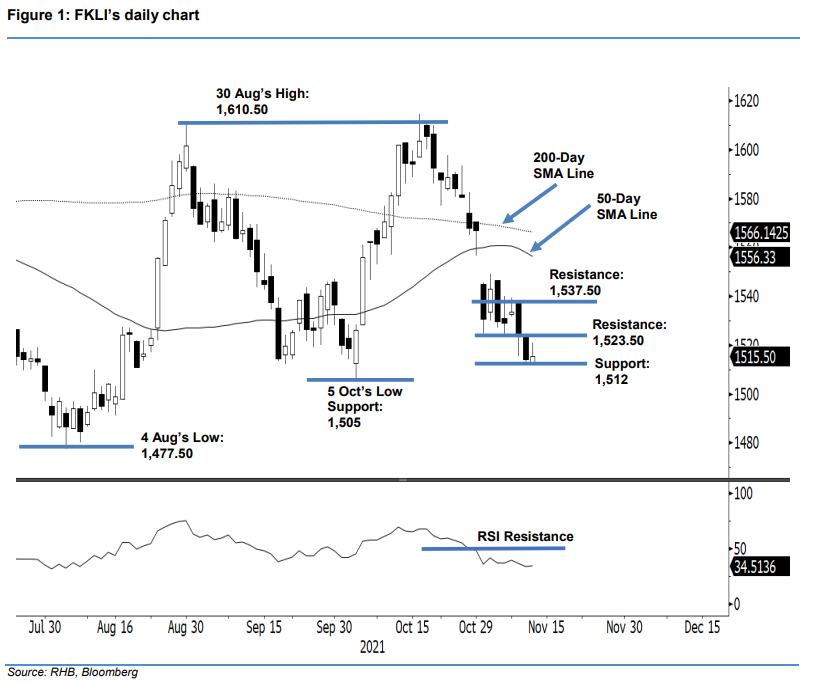

Maintain short positions. The bears took a breather yesterday, and the FKLI rebounded by 1.50 pts to close at 1,515.50 pts. Initially, the benchmark index opened weaker at 1,512 pts. However the negative momentum failed to follow through – the index climbed higher and touched the day’s high of 1,521 pts, before closing in positive territory. The latest session indicates that the downside risk is diminishing, and things are looking up. If the index climbs back above the 1,523.50-pt level, the previous bearish breakout would be regarded as a false breakout – which will attract buying pressure in the immediate session. This, with the RSI moving into oversold territory, implies that a technical rebound is around the corner. As such, we narrow the trailing-stop to protect the short positions. Pending a bullish reversal signal, we make no change to our negative trading bias.

Traders should remain in short positions, initiated at 1,584 pts or the closing level of 26 Oct. To control the trading risks, the trailing-stop threshold has been adjusted to 1,524 pts.

The immediate support changed to 1,512 pts (11 Nov’s low) followed by lower support of 1,505 pts (5 Oct’s low). The first resistance is eyed at 1,523.50 pts or the low of 1 Nov, and subsequent resistance at 1,537.50 pts or 9 Nov’s high.

Source: RHB Securities Research - 11 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024