COMEX Gold: Testing the Immediate Resistance

rhboskres

Publish date: Mon, 15 Nov 2021, 08:35 AM

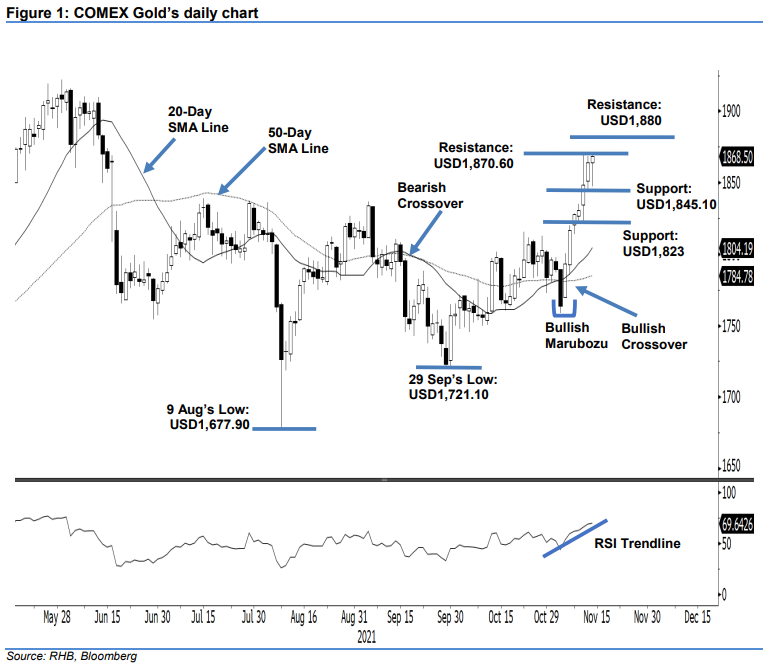

Maintain long positions. The COMEX Gold extended its upward movement last Friday for the seventh consecutive session, rising USD4.60 to settle at USD1,868.50. The commodity initially had a shaky early session, opening at USD1,864.30 and falling to the USD1,847.50 session low on profit taking. Strong buying momentum emerged during the US trading hours, lifting it higher to test the USD1,871.40 intraday high before closing stronger at USD1,868.50. The latest session saw the bulls still in the driver’s seat and eyeing to break past the USD1,870.60 immediate resistance. If the bullish breakout is successful, the precious metal will travel towards the higher hurdle pegged at USD1,880. At this stage, although the RSI is moving into overbought territory, the bullish momentum has yet to show any signs of weakness. As such, it is very likely that we will see a bullish price action follow-through. Hence, we stay with our positive trading bias.

Traders should stick to the long positions initiated at USD1,793.50 or the closing level of 4 Nov. To protect the trading risks, the trailing-stop threshold is set at USD1,835.

The nearest support remains at USD1,845.10 – 11 Nov’s low – and followed by USD1,823, ie 10 Nov’s low. The immediate resistance seen at USD1,870.60 – 10 Nov’s high – and then the higher resistance at USD1,880

Source: RHB Securities Research - 15 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024