WTI Crude: Correction Still in Progress

rhboskres

Publish date: Mon, 15 Nov 2021, 08:37 AM

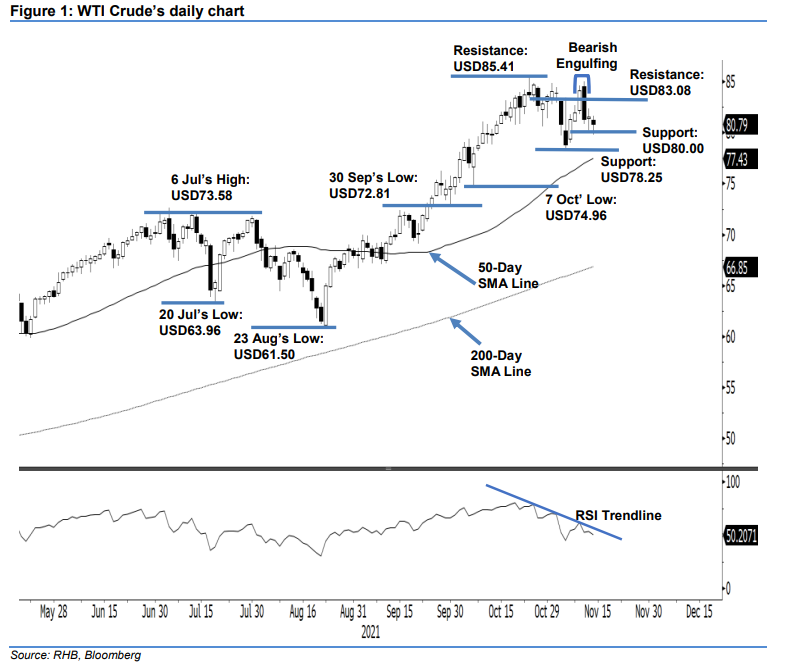

Maintain long positions. The WTI Crude continued to see price action weakness last Friday, falling USD0.80 to settle weaker at USD80.79. The commodity started off the session at USD81.21. Profit-taking activites dominated the first half of this session, dragging the WTI Crude to reach the USD79.78 session low. Although it rebounded during the US trading session to touch the USD81.62 session high, it closed below the opening price at USD80.79. Observed over the last three sessions: The commodity underwent corrections by printing “lower highs and lower lows” bearish patterns. Although it attempted to build an interim base near the USD80.00 threshold and formed a candlestick with long lower shadow, it has yet to rebound higher. As such, we deem the correction as still in play and there is a risk that we may see the psychological level giving way. Conversely, we expect the bulls to continue defending the critical level in coming sessions. We keep to a positive trading bias until the stop loss is breached.

We advise traders to hold on to the long positions initiated at USD84.15 – the closing level of 9 Nov. To manage downside risks, the intital stop-loss threshold is placed at USD80.00.

The support levels remains unchanged at USD80.00, and USD78.25, ie 4 Nov’s low. Conversely, the nearest resistance level is sighted at USD83.08 – 3 Nov’s high – and followed by USD85.41, or the high of 25 Oct.

Source: RHB Securities Research - 15 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024