FCPO: Upside Movement Capped At MYR5,000

rhboskres

Publish date: Mon, 15 Nov 2021, 08:50 AM

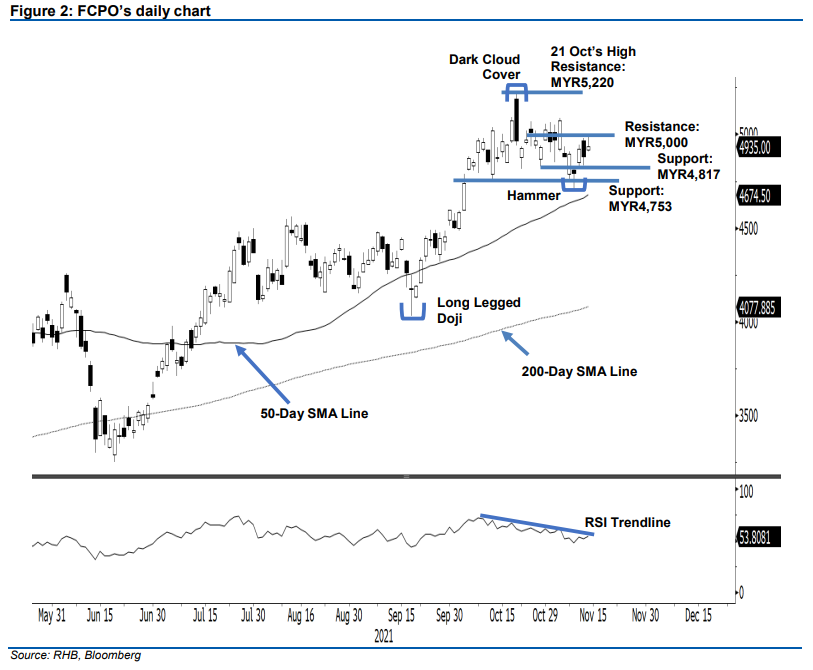

Maintain short positions. Last Friday, the FCPO could not stage a bullish breakout – it closed MYR54.00 higher, at MYR4,935. The commodity gapped up at the open, at MYR4,917. Not long after, it rapidly climbed towards the session’s high of MYR4,995. However this was followed by profit-taking in the afternoon, and the FCPO retraced towards the session’s low of MYR4,909, then closed at MYR4,935. Based on the last four trading sessions, the commodity has been scaling higher on a “higher lows” bullish pattern. If such a trend continues, it may try again to break above the MYR5,000 mark. Note that 15 Nov marks the last trading session before most active futures contracts move to a Feb 2022 basis, on 16 Nov. As such, volatility may ramp up today. However, Friday’s session also showed that the candlestick formed a long upper shadow, and this affirmed selling pressure still persists at the MYR5,000 psychological level. As long as the commodity continues to trade below this critical threshold, we think the downrisk will stay in place. As such, we maintain a negative trading bias until the stop-loss has been breached.

Traders should stick to short positions which were initiated at MYR4,880 or the closing level of 5 Nov. To manage trading risks, the initial stop-loss has been set at MYR5,000.

The immediate support is at MYR4,817 (10 Nov’s high), followed by MYR4,753 (13 Oct’s low). Meanwhile, the immediate resistance is at the psychological level of MYR5,000, followed by MYR5,220 or 21 Oct’s high.

Source: RHB Securities Research - 15 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024