FCPO: Consolidating Below The MYR5,000 Mark

rhboskres

Publish date: Tue, 16 Nov 2021, 08:39 AM

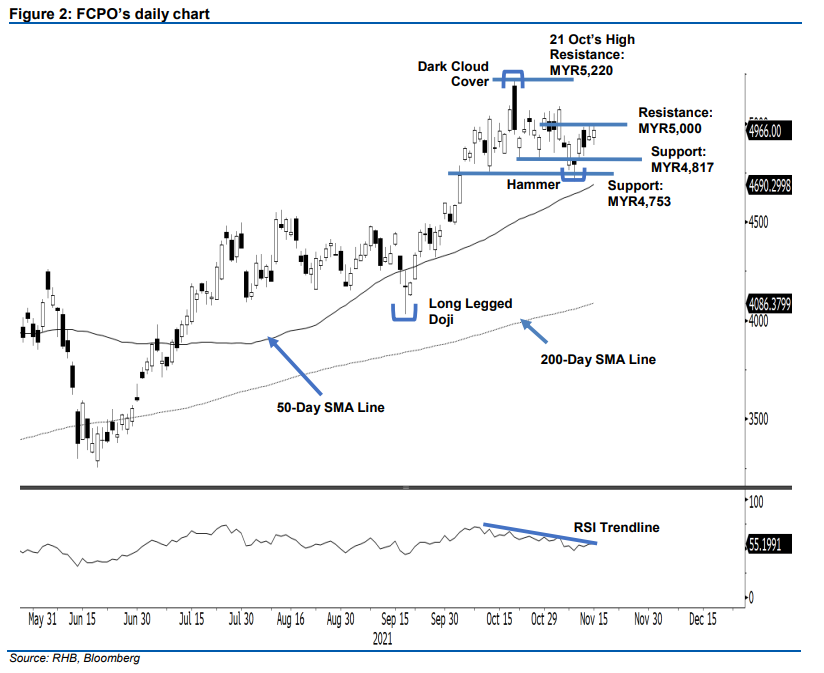

Maintain short positions. The FCPO staged a fresh attempt to cross the MYR5,000 treshold, but the bullish price action only manage to advance MYR31.00 higher to settle at MYR4,966. The Jan 2022 futures contract saw a session of two yesterday. Initially, it opened at MYR4,930 and dropped to the day’s low of MYR4,890 on profit taking. Then in the afternoon session, strong buying interest lifted it higher to test the day’s high of MYR4,997 before the close. The latest session showed the bulls were in control of the session. However, the positive momentum was not strong enough to break past the MYR5,000 mark. As such, the commodity may resort to consolidation in the coming session. At this stage, we believe MYR4,817 and MYR4,753 will provide strong downside support. Post consolidation, the FCPO may stage a fresh attempt to retest the MYR5,000 mark. Traders do take note that on 16 Nov, the most active futures contract will change to Feb 2022 (which settled at MYR4,766) – expect a gap on Tuesday’s opening. We stick to a negative trading bias until the stop-loss has been triggered.

Traders should hold on to short positions, which were initiated at MYR4,880, or the closing level of 5 Nov. To manage trading risks, the initial stop-loss is fixed at MYR5,000.

The immediate support stays at MYR4,817 (10 Nov’s low), followed by MYR4,753 (13 Oct’s low). On the upside, the nearest resistance is pegged at the psychological barrier of MYR5,000, followed by MYR5,220, or 21 Oct’s high.

Source: RHB Securities Research - 16 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024