COMEX Gold: Mild Profit-Taking Near the Resistance

rhboskres

Publish date: Tue, 16 Nov 2021, 08:43 AM

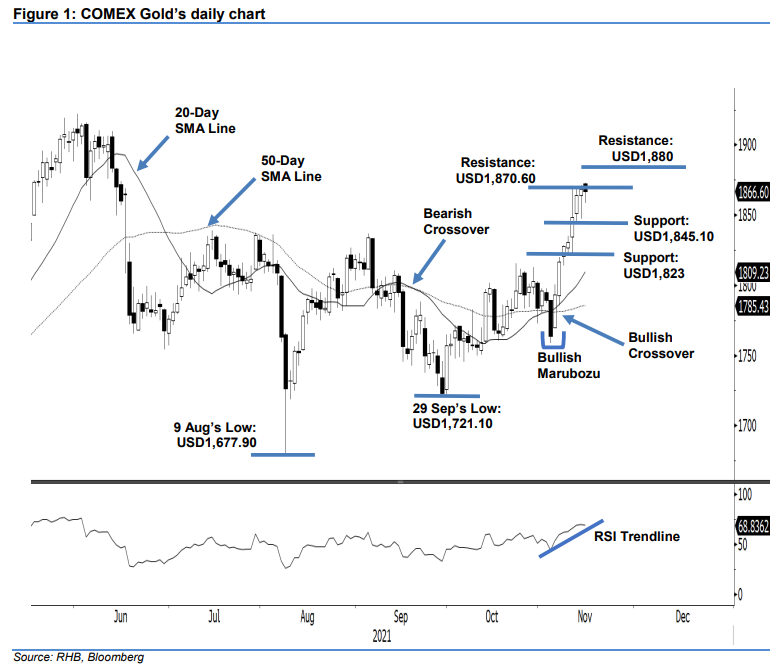

Maintain long positions. Yesterday, the COMEX Gold saw mild profit-taking near the immediate resistance, falling USD1.90 to settle at USD1,866.60. It opened at USD1,872.60 and oscillated between USD1,873 and USD1,858.50 before closing at USD1,866.60. Despite the upward movement being capped by the immediate resistance, the commodity managed to chart a “higher low” during the session. Therefore, we deem the bullish structure as intact. As the RSI is moving into overbought territory, the commodity may see a mild correction in coming sessions due to profit-taking. If this happens, we expect strong support to be found near USD1,845.10. Meanwhile, a breach of the USD1,870.60 immediate resistance would lead to the commodity reaching a fresh 5- month high. As the yellow metal is consolidating near the resistance, we hold on to our positive trading bias.

Traders are advised to retain the long positions initiated at USD1,793.50 or the closing level of 4 Nov. To mitigate downside risks, the trailing-stop threshold is placed at USD1,835.

The nearest support is kept at USD1,845.10 – 11 Nov’s low – followed by USD1,823, or 10 Nov’s low. The immediate resistance remains at USD1,870.60 – 10 Nov’s high – and the USD1,880 whole number.

Source: RHB Securities Research - 16 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024