FKLI: Consolidating Near The Support

rhboskres

Publish date: Wed, 17 Nov 2021, 04:43 PM

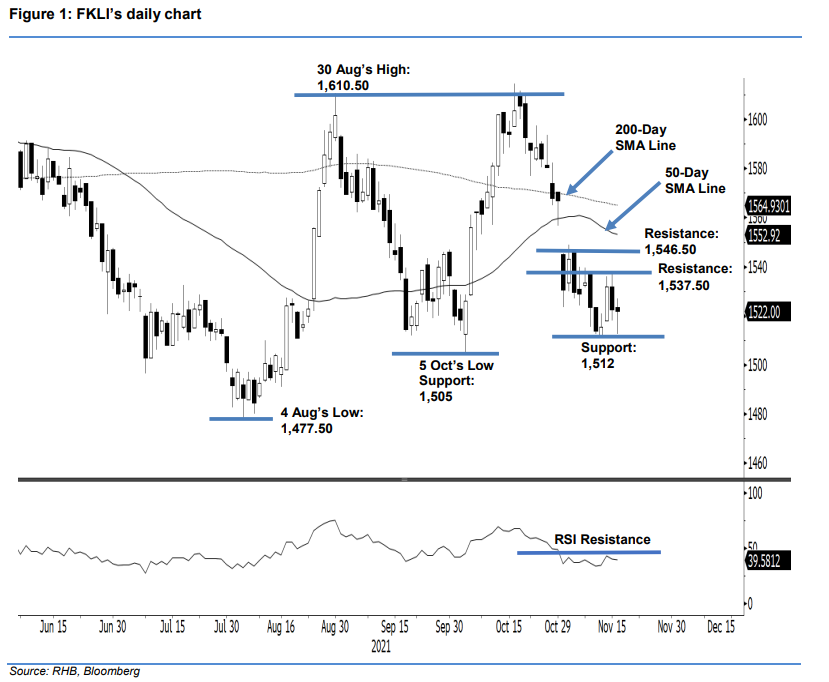

Maintain long positions. The FKLI staged a strong rebound from the support, despite dipping 0.5 pts to settle at 1,522 pts. Yesterday, the benchmark index opened at 1,523.50 pts and slipped to the day’s low of 1,512.50 on panic selling. However, as the support level of 1,512 pts managed to withstand the selling pressure, the index made a quick rebound towards the day’s high of 1,527 pts. Subsequently, the index moved sideways for the rest of the session and closed at 1,522 pts – printing a candlestick with a long lower shadow on the chart. The latest price action showed that the bears respected the support level and did not breach the threshold. As such, it is likely the index will consolidate sideways along the support, eyeing to cross the upside resistance. As long as the support stays intact, we expect to see a “higher low” formation in the coming sessions. We stick to our bullish trading bias until the stop-loss is breached.

We advise traders to hold on to the long positions, which were initiated at 1,532 pts or the closing level of 12 Nov. For management of trading risks, an initial stop-loss is set at 1,500 pts.

The immediate support is marked at 1,512 pts – 11 Nov’s low – and subsequently at 1,505 pts, or the low of 5 Oct. The nearest resistance is eyed at 1,537.50 pts (9 Nov’s high), followed by 1,546.50 pts (3 Nov’s high).

Source: RHB Securities Research - 16 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024