FCPO: Testing The Immediate Support

rhboskres

Publish date: Wed, 17 Nov 2021, 04:44 PM

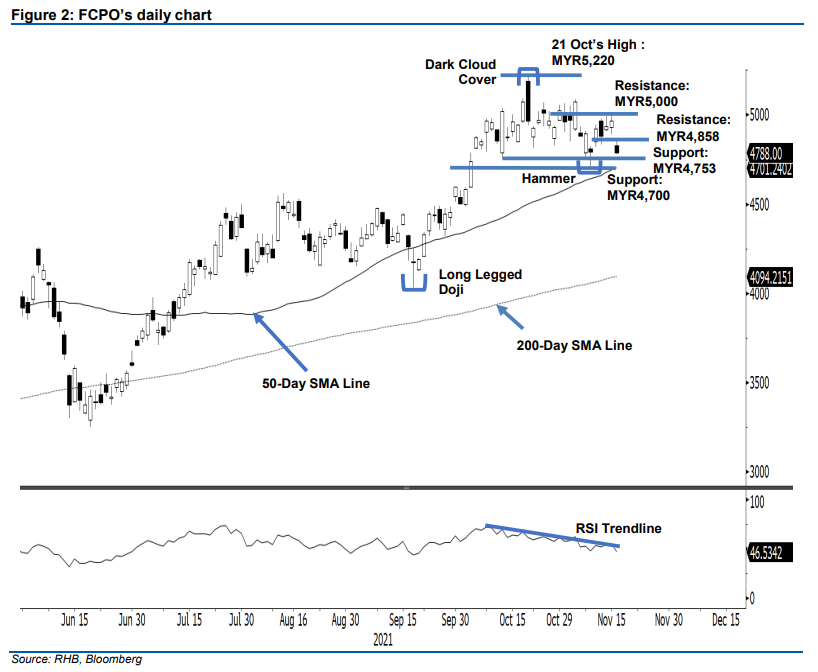

Maintain short positions. The FCPO saw mild profit taking during Tuesday’s session – the Feb 2022 futures contract last traded at MYR4,788. Initially, the commodity started off at MYR4,830, then rose higher during the first half of the session to test the day’s high of MYR4,858. However, selling pressure emerged in the afternoon, causing it to retrace towards the day’s low of MYR4,780 before the close. As the commodity has formed a bearish candlestick, it may see a follow through price action, pulling back to retest the MYR4,753 immediate support. Meanwhile, observe that the 50- day SMA line is trending higher, and moving closer to the commodity price chart. With the confluence of the medium-term moving average line, we expect strong support to be established in the region of MYR4,753 and MYR4,700. In the event the lower support, or the MYR4,700 level gives way, this will dent market sentiment and attract further selling pressure. At this juncture, we lower the stop-loss while holding on to our negative trading bias.

Traders should retain the short positions, which were initiated at MYR4,880, or the closing level of 5 Nov. To manage trading risks, the stop-loss is revised to MYR4,860 from MYR5,000.

The immediate support is adjusted to MYR4,753 (13 Oct’s low), followed by MYR4,700. Conversely, the first resistance is revised to MYR4,858 – the high of 16 Nov – followed by the MYR5,000 whole number.

Source: RHB Securities Research - 17 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024