COMEX Gold: Bouncing Off Above the Immediate Resistance

rhboskres

Publish date: Thu, 18 Nov 2021, 05:58 PM

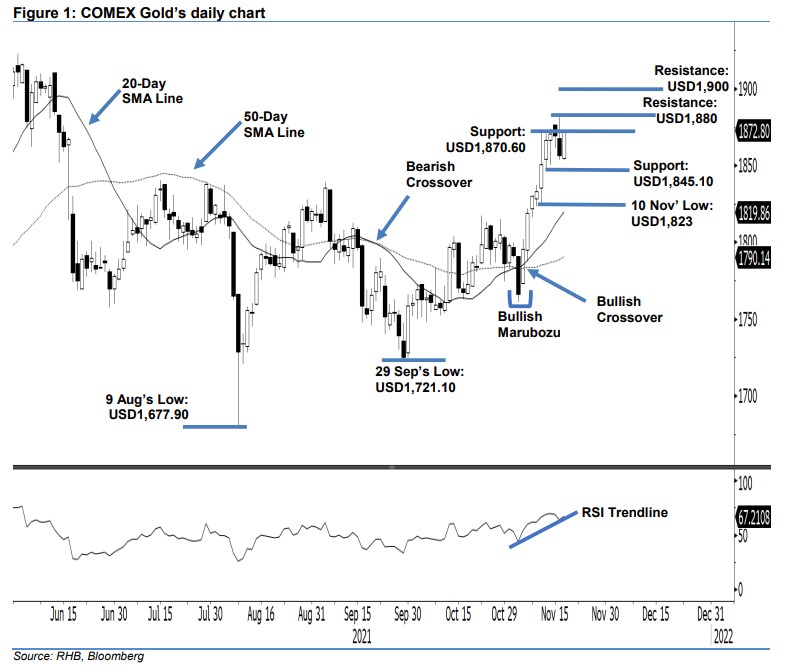

Maintain long positions. The COMEX Gold rebounded from its recent pullback yesterday as it climbed USD16.10 to settle at USD1,872.80. Despite opening lower at USD1,854.50 to merely touch the USD1,853.80 day low, the commodity swiftly changed direction northwards until end of the session and was propelled towards the USD1,873.10 day peak before the close. This latest bullish session has partially nullified the bearish candlestick printed during the previous session, which consequently re-affirmed its earlier paused uptrend movement from the recent pullback. As the COMEX Gold breached the USD1,870.60 immediate resistance yesterday, there is a high possibility for the commodity to climb higher to hit the USD1,880 immediate resistance. With that in mind, we hang on to our positive trading bias unless the trailing stop is breached.

We recommend traders stick to the long positions initiated at USD1,793.50 or the closing level of 4 Nov. To limit the downside risks, the trailing-stop threshold is placed at USD1,845.

The immediate support is marked at USD1,870.60 – 10 Nov’s high – and followed by the lower support at USD1,845.10, ie 11 Nov’s low. The first resistance is seen at USD1,880 and then at the USD1,900 round number.

Source: RHB Securities Research - 18 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024