FCPO: Bouncing Above The Immediate Resistance

rhboskres

Publish date: Thu, 18 Nov 2021, 06:00 PM

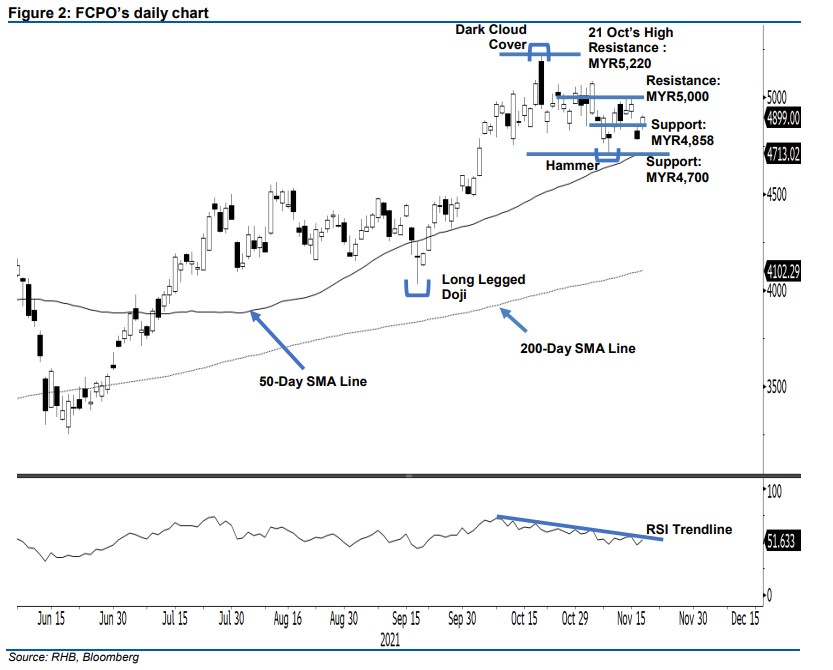

Trailing-stop triggered; initiate long positions. The FCPO rebounded higher yesterday following profit-taking activies. It gained MYR111.00 to close at MYR4,899, which is above the MYR4,860 immediate resistance. Yesterday, commodity opened at MYR4,855, then oscillated sideways during the first half of the session to test the day’s low of MYR4,831. Then, buying momentum re-emerged to propel the FCPO further north towards the day’s peak of MYR4,910 before the close. The bullish candlestick printed above the trailing-stop level of MYR4,858 yesterday may trigger a counter-trend rebound in the coming sessions – as the bullish momentum is expected to follow through towards the MYR5,000 resistance. Supported by the strengthening of the RSI towards the >50% level, we believe the uptrend rebound has just begun. Since the trailing-stop is triggered, we shift to a positive trading bias.

We closed out short positions, initiated at MYR4,880 or the closing level of 5 Nov, after the trailing-stop at MYR4,860 was triggered. Conversely, we initiate long positions at the closing level of 17 Nov at MYR4,899. To manage trading risks, the initial stop-loss is at MYR4,700.

The immediate support is located at MYR4,858 (16 Nov’s high), followed by MYR4,700. Conversely, the nearest resistance is set at MYR5,000, followed by MYR5,220 – 21 Oct’s high.

Source: RHB Securities Research - 18 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024